Geopolitical cohesion key driver of EU trade - Deloitte report

Geopolitical cohesion is becoming a key driver of European trade relationships, according to Deloitte’s 2025 Geoeconomic Dynamics Index, published on 6 August. The report draws on more than 59mn data points, including bilateral trade flows, sanctions exposure, financial integration and United Nations voting behaviour, to map the relationship between political alignment and trade.

“For Europe, analysis of the historical data shows that a 1% drop in geopolitical alignment is associated with a corresponding 1% decline in trade intensity,” Deloitte observed.

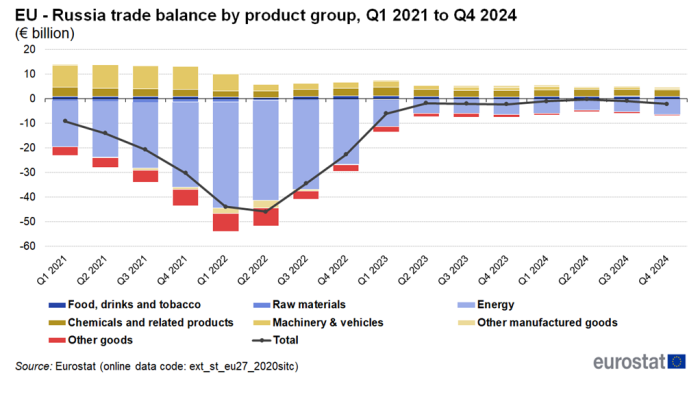

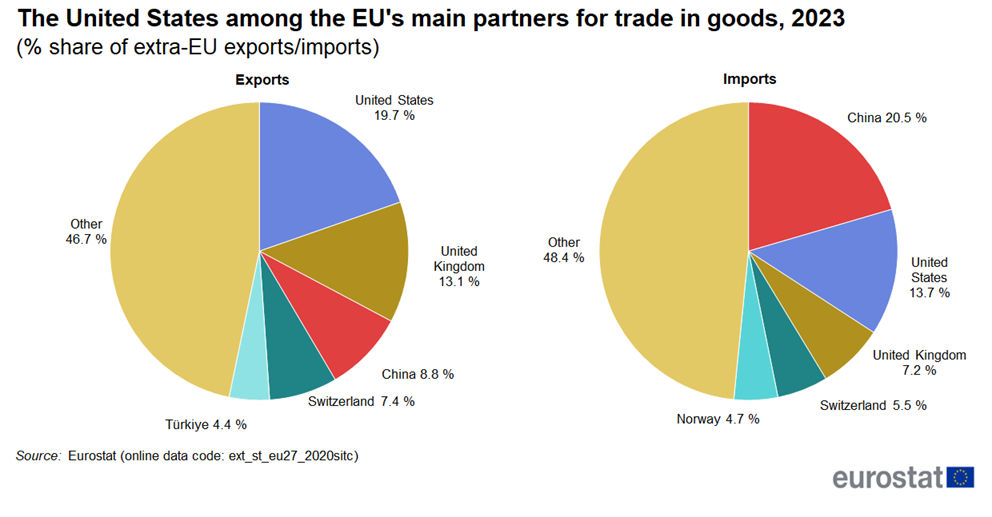

The pattern is stark: the report notes that Europe’s trade with Russia “fell sharply” after the country’s full-scale invasion of Ukraine in 2022, while EU–US trade and investment flows rose nearly 40% from 2020 to 2024, alongside marked growth in foreign direct investment.

CEE exposure, Indo-Pacific opportunities

While Deloitte does not single out Central and Eastern Europe (CEE), the findings have implications for the region’s export strategies. Countries with strong supply-chain links to Indo-Pacific partners could benefit from the reconfiguration.

Automotive manufacturing hubs such as Hyundai’s Nosovice plant in east Czechia, Kia’s Zilina plant in north Slovakia, and Toyota’s Kolin plant in central Czechia already anchor production to Japanese and Korean markets. Czechia adopted an Indo-Pacific strategy in 2022, identifying Japan, South Korea, India and ASEAN states as priority partners for trade diversification.

By contrast, Hungary and Serbia maintain substantial energy and investment ties with Russia and China - “lower-alignment” partners in Deloitte’s framework - increasing exposure to the supply-chain risks and regulatory frictions the report warns about.

Hungary continues to import Russian oil and gas and is proceeding with the Russia-backed Paks II nuclear expansion, according to news agency Reuters. Analysts also note Serbia’s heavy involvement in Chinese-funded infrastructure projects, from road construction to energy facilities.

EU forms stronger links with political allies

Deloitte forecasts that European exports to Japan will grow by around 4.1% annually, and to South Korea by 3.3% annually, driven by strategic convergence, regulatory alignment and targeted trade agreements.

Emerging Asian economies including India, Indonesia, Vietnam and the Philippines also offer growth potential, but Deloitte warns that “without sustained geopolitical alignment, trade growth with these markets may be fragile.”

By contrast, trade with Belarus, Iran, China and Russia is forecast to decline further due to deteriorating political cohesion, sanctions and regulatory divergence.

EU-wide strategic planning on agenda

Deloitte says European firms should treat geopolitics as “a strategic variable on par with cost, market potential, and proximity”, investing in geoeconomic intelligence, supply-chain resilience, and direct engagement with policymakers through trade associations and strategic forums. The firm frames this as “more than risk mitigation… about shaping the operating environment and demonstrating leadership.”

The European Commission is reviewing its economic security strategy and outbound investment screening framework, with further measures expected by the end of 2025.

Deloitte concludes that Europe’s trade future will be shaped less by market size and more by trust, policy coordination and shared long-term interests. Companies that fail to adapt, it warns, risk exclusion from the emerging order.