'Poland: growth leader in Europe and the world'- FM proclaims on 2024 data

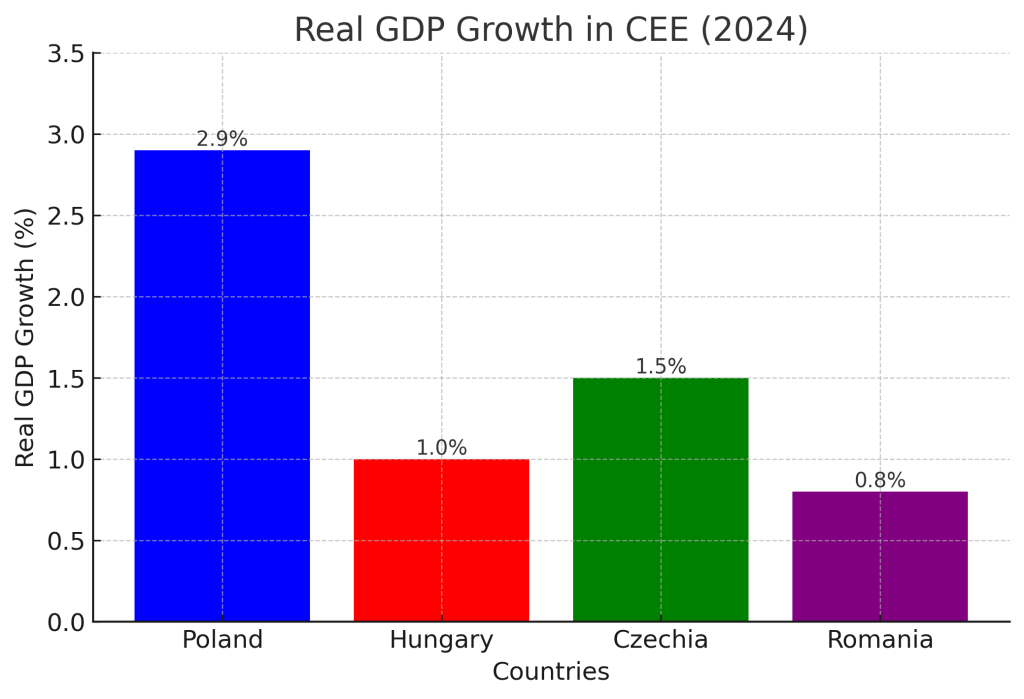

Poland’s economy emerged as a regional standout in 2024, recording a GDP growth of 2.9%, significantly outpacing its Central and Eastern European (CEE) peers, according to an ING Bank analysis that cited Poland’s StatOffice.

While other CEE economies fell short of expectations, Poland’s economic expansion was broadly in line with forecasts made a year earlier. The final quarter of 2024 saw a marked acceleration, with estimated GDP growth of 3.5% year-on-year, driven by a resurgence in household consumption and public investment.

Polish Finance Minister Andrzej Domanski wrote on X that “this is: more than 3 times faster than the eurozone (1 %), much faster than the average for developed economies (1.9 %) and the EU (1.4 %), more dynamic than emerging economies in Europe (2.2 %) and above the average growth for the entire world economy (3.3 %).

“Internal forecasts even indicate an increase of 3.9%. For comparison, when we took over, Poland’s economic growth was 0.1%. Poland: growth leader in Europe and the world,” Domanski proclaimed.

Consumption drives growth

Household consumption rose by 3.1% in 2024, a notable improvement from the 0.3% contraction in 2023. Public consumption also surged by nearly 7%, up from 4% the previous year, reflecting government spending support. However, fixed investment growth slowed to 1.3%, compared to a robust 12.6% expansion in 2023.

A negative foreign trade balance weighed on overall performance, deducting 1 percentage point from GDP growth, reversing the previous year’s 3.2-percentage-point contribution from net exports.

Pole position in V4

Unlike Poland, most CEE economies underperformed against initial growth projections. Czechia’s GDP growth was approximately a third lower than expected, while Hungary and Romania fell short by as much as two-thirds. Poland’s resilience can be attributed to its robust consumer demand and strategic government spending, according to the bank’s analysis.

ING wrote: “The picture this paints for the Polish economy – along with a hawkish policy stance from the National Bank of Poland (NBP) – should allow the Polish zloty to remain strong, or even firm up further than we had expected.

“The PLN outlook also depends on developments regarding the ongoing war in Ukraine and actions undertaken by the new US administration on that matter. Initial signs indicate that after taking office, President Donald Trump leans towards a more positive approach for the region than he suggested during his presidential campaign,” ING added.

Outlook for year ahead

Poland’s economic growth is projected to surpass 3% in 2025, underpinned by household spending and fixed investment. “We think Poland’s 2025 growth should accelerate above 3% as domestic consumption continues to grow and public investments kick in,” ING wrote.

According to earlier reports, the European Commission will free up tens of billions of euros in blocked aid to Polish Prime Minister Donald Tusk’s government, which toppled the eurosceptic party Law and Justice (PiS) after eight years in power, in October 2023.

ING wrote that “the influx of EU Recovery and Resilience Funds (RRF) and structural funds will play a crucial role, with an estimated PLN 50bn (EUR 11.93bn) in RRF grants, PLN 40bn (EUR 9.54bn) in RRF loans, and PLN 45bn (EUR 10.74bn) from structural funds expected to enter the economy.

Poland’s ability to sustain strong growth while its CEE peers struggle underscores its resilience and strategic policy framework. With public investment ramping up and private consumption remaining steady, Poland is well-positioned to maintain its economic momentum into 2025.

PKO Bank Polski analysts wrote “in the current year, we expect growth to accelerate further: after savings are rebuilt, household attention will shift to consumption, a drop in interest rates and a new injection of EU funds can clearly support investment and revive domestic production.”