EU looks to Greece for critical raw materials

Greece is poised to become a key player in the EU’s efforts to secure critical raw materials (CRMs) due to its richness in minerals such as nickel and magnesium, making it a strategic asset for a Europe increasingly focused on supply chain autonomy.

The Balkan country is already a major producer of bauxite, which is essential for aluminum production. Additionally, exploratory projects are underway to assess the feasibility of extracting lithium and rare earth metals, which are crucial for electric vehicle batteries and renewable energy systems.

With increasing global competition for these resources, particularly from China, the EU is working to reduce its dependency on external suppliers by investing in domestic mining, refining, and recycling capacities. Due to industrialisation, digitalisation and climate neutrality goals, global material demand is expected to more than double by 2060.

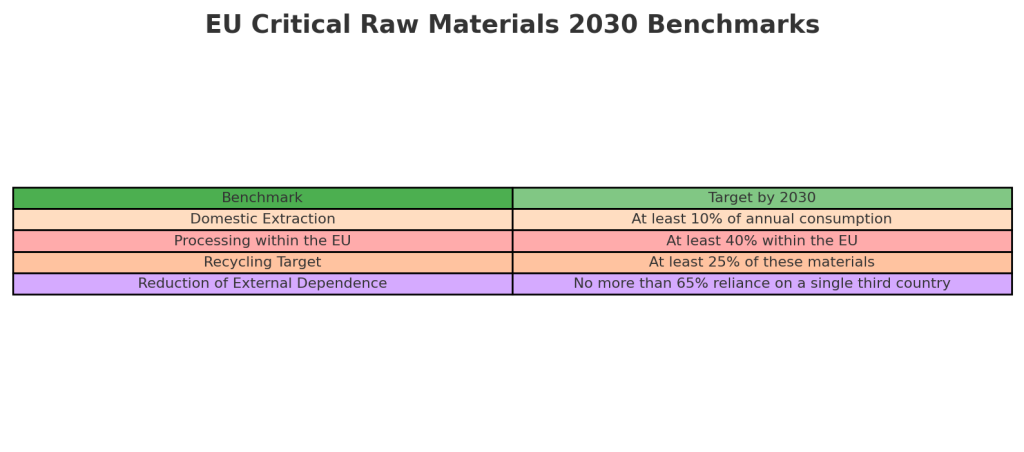

The bloc aims to produce at least 10% of the critical raw materials it consumes, process 40% within the EU, and recycle 15% of CRMs by 2030, and Greece has been identified as a potential leader in helping meet these goals.

Gov’t plans mining tenders

Greece’s natural resource wealth and strategic location could make it a crucial part of the EU’s push for green and digital transitions. Last month, Greek Deputy Environment and Energy Minister Alexandra Sdoukou launched a tender for the exploration and exploitation of antimony on the island of Northern Chios.

The government is expected to launch this year tenders for graphite deposits in Thermes, north-east Greece, and manganese oxide in Drama, north-east Greece. Greek company Metlen Energy & Metals will produce gallium in Boeotia, and another tender is expected to mine copper and tungsten deposits near Xanthi, north-east Greece.

Meanwhile, Rockfire Resources has detected germanium, one of the world’s rarest critical metals, and plans to move forward with extraction operations. Antimony, used in alloys with lead and tin, has been detected in Rodopi and Kilkis, north Greece. Several other locations have been identified as holding untapped reserves, including the seabed.

Beyond mining, Greece’s proximity to European industrial centres and global trade routes, as well as its developed ports and logistical networks, make it an ideal processing and export hub.

EU’s push for resource security

The EU has stated ITS increasing need for a stable supply of CRMs for producing batteries, semiconductors, renewable energy technologies and defence applications.

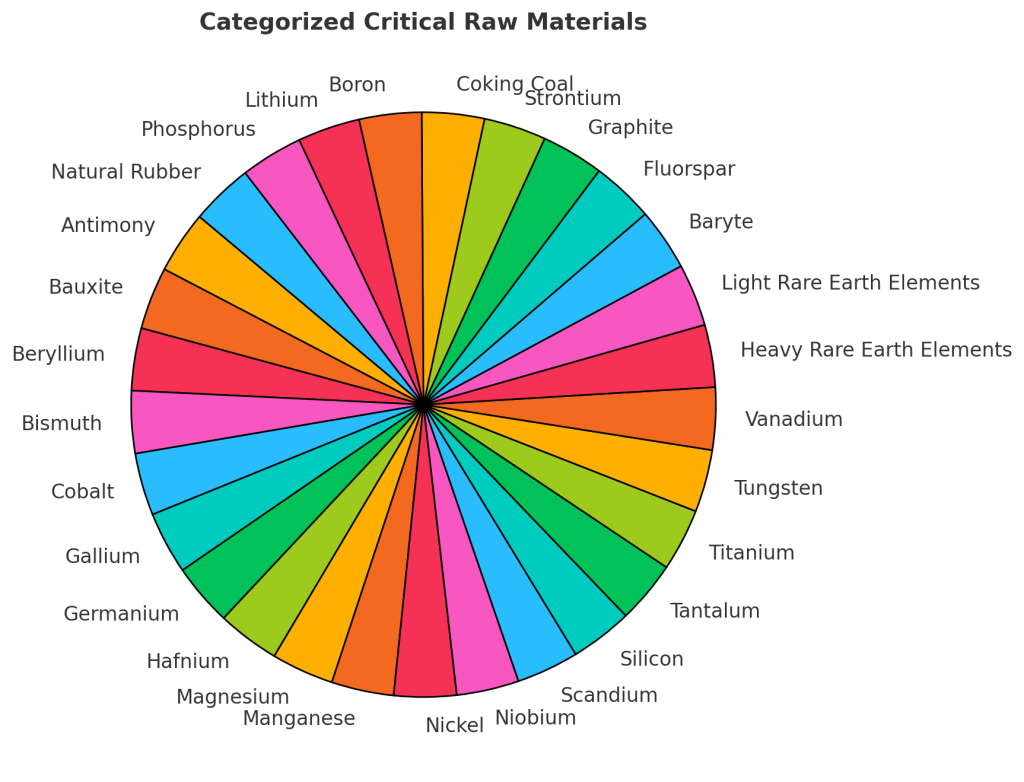

The European Commission began to explore this strategy in 2011, when it drew up a list of 14 CRMs. The most recent update in 2023, which took the form of the European Critical Raw Materials Act, expanded the list to 34 CRMs. This legislation aimed at strengthening internal supply chains, also set targets for reducing reliance on non-EU sources, promoting sustainable extraction and establishing recycling networks.

Greece’s resource potential

To capitalise on its geological advantages, Greece has been attracting significant foreign and domestic investment in mining and processing facilities. The country has been working with EU institutions to ensure compliance with environmental and sustainability standards while cutting red tape to accelerate development.

One major project under discussion is the expansion of lithium extraction initiatives, aiming to provide a sustainable source of battery materials for European manufacturers. Efforts to modernise refining capacities would also enable Greece to process more of its raw materials domestically, adding value before export.

EU Sourcing of CRMs

While China dominates globally, the EU sources certain CRMs from different suppliers. Bauxite is mostly sourced from Guinea (64%), lithium is mostly sourced from Chile (78%), phosphorus is primarily sourced from Kazakhstan (71%) and fluorspar is mainly sourced from Mexico (25%).

China is the planet’s primary source of antimony, bismuth, gallium, germanium, magnesium, rare earth elements, silicon metal and tungsten, while South Africa and Russia are major suppliers of platinum group metals. The US is the key supplier of beryllium, Brazil dominates niobium supply, Australia is the largest supplier of bauxite, Chile dominates lithium supply, and the Democratic Republic of the Congo is the main supplier of cobalt.

Challenges, future outlook

Despite its strategic advantages, Greece faces challenges if it is to become a leading supplier of critical raw materials within the EU, including environmental concerns, excessive red tape and local opposition to mining operations. Additionally, competition from other European nations including Serbia means Greece will need to move swiftly to solidify its position.

As the EU moves towards greater resource independence, Greece’s role in securing critical raw materials will be pivotal. If successfully developed, its mining and processing sectors could not only enhance European supply security but also drive economic growth and technological innovation within Greece itself.