Vilnius, Warsaw climb tech rankings, CEE gains visibility

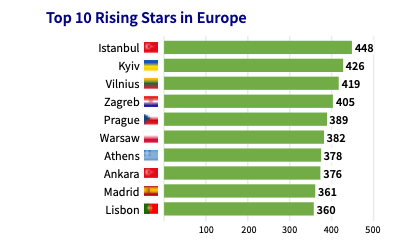

Central and Eastern Europe (CEE) gained new recognition in Dealroom’s 2025 Global Tech Ecosystem Index, with CEE capital cities Vilnius, Lithuania; Warsaw, Poland; and Zagreb, Croatia, named among the world’s top 100 emerging innovation hubs.

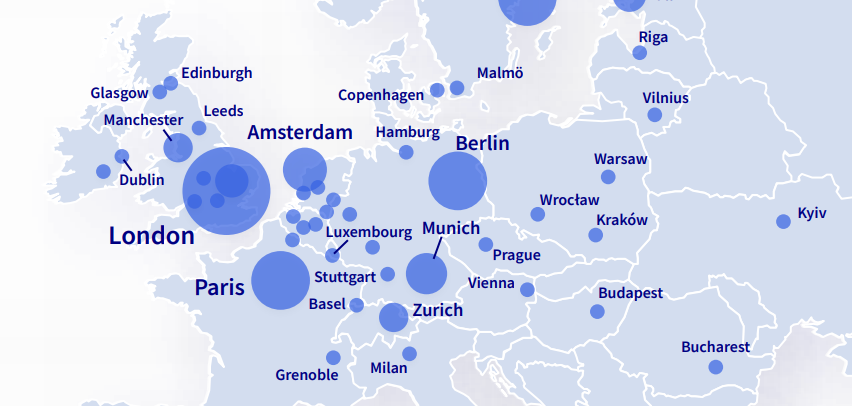

The index, released on 21 May, ranked 288 cities worldwide. While Paris and London top the European list, the report highlights improved visibility for several cities in the Baltics and Visegrad Four countries. Dealroom analysts noted rising early-stage funding activity, stronger founder networks and improved public-private alignment in CEE.

Lithuania rose 18 places

Vilnius rose 18 places from the previous year, ranking highest among the Baltic capitals, three places above Zagreb, Croatia. Lithuanian officials said the gain reflected investments in fintech regulation, university partnerships and state-backed acceleration. Warsaw also climbed into the top 70, driven by founder retention and a growing number of internationally focused startups. Zagreb and Tallinn were listed among the top “rising ecosystems”, based on funding increases and founder density.

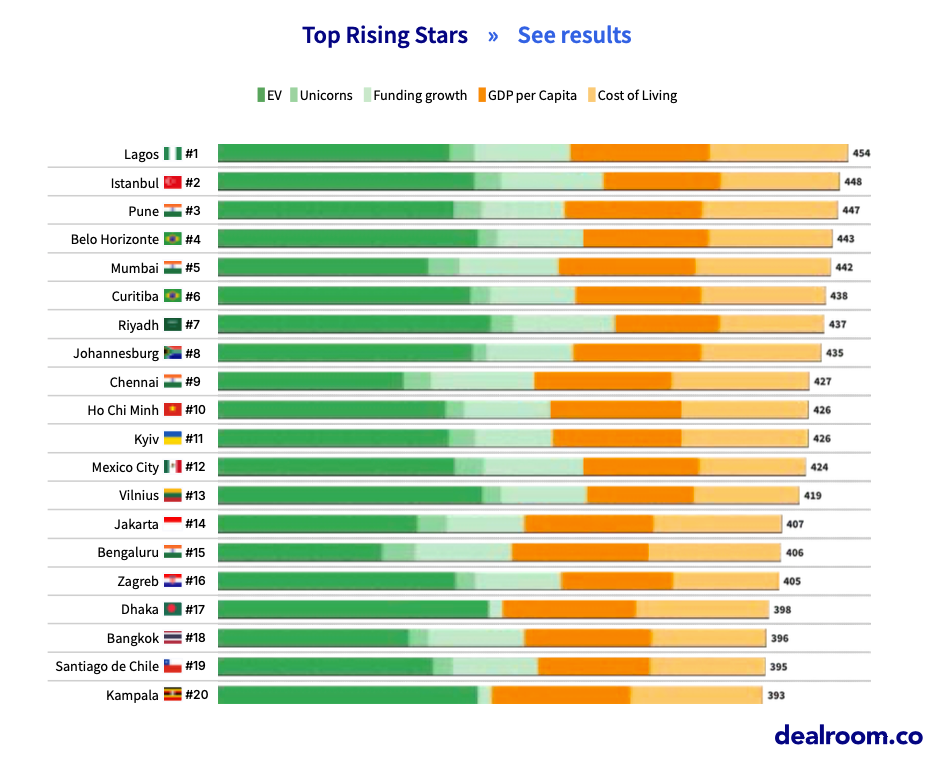

The Lithuanian capital also ranked 13th globally among “Rising Stars,” leading the Baltics in startup ecosystem momentum. Dealroom credits Vilnius with improving fintech regulation, increased public co-investment, and a steady pipeline of university-linked founders. Warsaw entered the top 70 globally, with its ecosystem buoyed by founder retention and a surge in international seed and Series A deals.

Despite progress, analysts warned that structural challenges remain. Several CEE cities still lack consistent access to late-stage capital, and regional investors remain heavily dependent on European and US fund participation.

Policy efforts vary across the region

Local founders interviewed by Dealroom cited difficulties in accessing cross-border legal support, growth-stage mentoring and acquisition pathways. Some also pointed to rising competition from Southeast Asia and Latin America, where funding rounds are often larger and exits are more frequent.

Policy efforts vary across the region. Baltic states have invested in digital visa schemes and tax incentives for returning founders. Poland’s government has backed regional venture platforms with EU funds, while Slovakia and Romania have focused on university-linked incubators. Still, critics argue that many national strategies lack follow-through, with high startup formation rates masking weak scale-up pipelines.

Dealroom used criteria including startup density, international venture capital, talent pipeline and scale-up potential. It said its methodology favoured ecosystems with sustained venture activity and growing founder depth.

Several CEE cities performed strongly on university-startup integration but lagged on metrics such as market reach, late-stage M&A and participation in international consortia. EU-backed programmes such as the European Innovation Council and Digital Europe support the region, but outcomes remain uneven, Dealroom added.