CEE's evolving e-commerce landscape

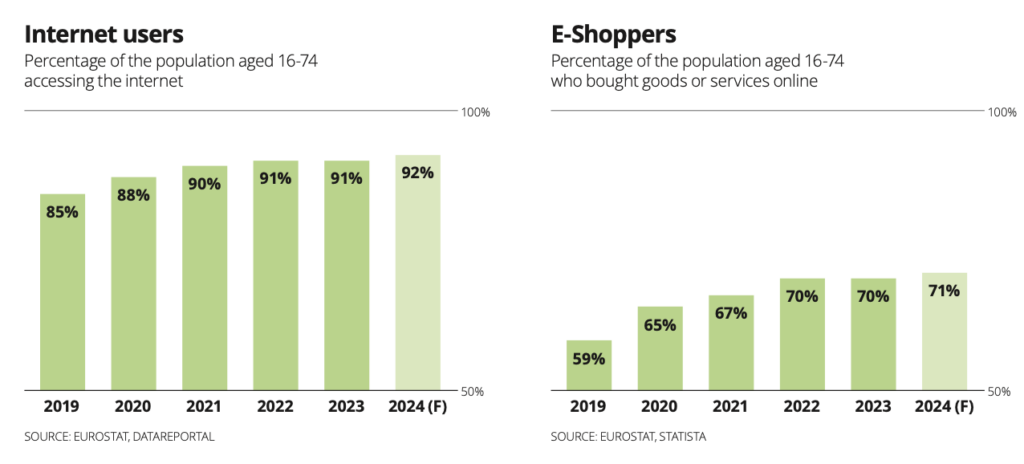

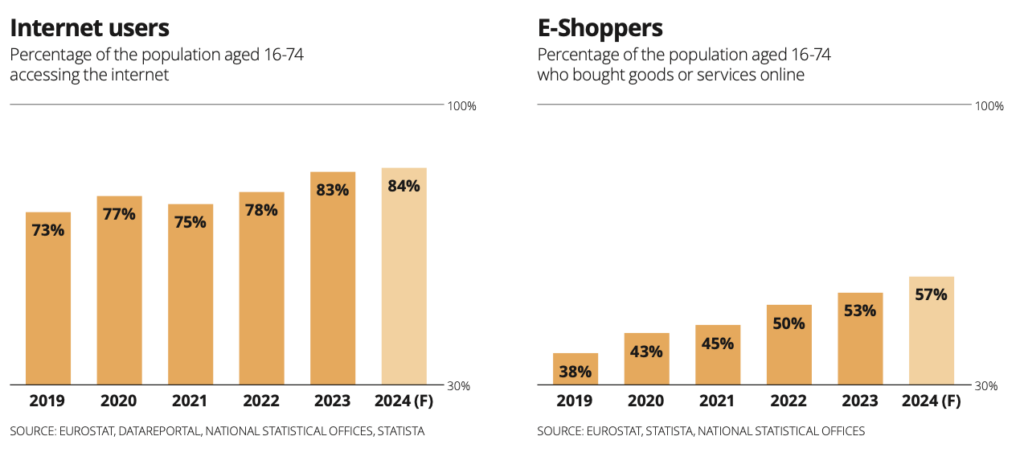

Central and Eastern Europe (CEE) is catching up with Western Europe for e-commerce, but unique regional challenges and opportunities are shaping its growth trajectory, according to the European e-Commerce Report 2024.

Central Europe

Many CEE countries still experience uneven digital development, as compared to Western Europe where higher internet penetration and e-commerce are both established. Poland, Czechia, Romania and Hungary are developing but face barriers to the pace of digital adoption and cross-border trade, found the report, which was based on data compiled for Ecommerce Europe by the Amsterdam University of Applied Sciences and the CMI HvA Centre for Market Insights.

While local players in these markets benefit from regional expansions, the overall e-commerce ecosystem still lags behind its Western European counterparts. An exception is Austria, which has a more stable and mature e-commerce market compared to its counterparts further east. High internet penetration and a well-developed logistics network support its robust online shopping environment.

However, Austrian consumers are cautious spenders, often prioritising trusted local brands over foreign competitors and e-commerce businesses are among the early adopters of green initiatives. Cross-border shopping is common, particularly with Germany, but Austria’s proximity to emerging e-commerce markets in CEE makes it a critical link for digital commerce expansion east.

Cross-border challenges, logistical hurdles

Romania has a 96% internet user rate, while only 19% of its population is involved in cross-border e-commerce. Romanian Association of Online Stores Executive Director Cristian Pelivan said Romania is working on an “ongoing effort to implement EU regulations such as the Digital Services Act and the Digital Markets Act. The policy landscape is dynamic, with new or revised policies focusing on various topics, from taxation and consumer rights to digital security.

“Notably, two pending legislative measures are set to significantly benefit the Romanian e-commerce sector: the enactment of a modernised law on e-signatures and the implementation of eIDs,” Pelivan added.

Hungary and Czechia have growing local e-commerce, though the region lacks the unified digital framework needed for seamless, widespread online shopping experiences, according to the report. Fragmented digital policies, coupled with varying consumer preferences, make it difficult for businesses to scale their operations across CEE borders.

While Poland nears 94% internet penetration, its e-commerce adoption is concentrated locally, with only 13% of Polish shoppers making cross-border purchases.

Logistical inefficiencies and infrastructure challenges remain a significant obstacle to the growth of cross-border e-commerce in CEE. Poland and Romania are already exploring ways to enhance logistical efficiencies, but more needs to be done on a regional level to fully unlock CEE’s e-commerce potential.

Although the EU Single Market aims to facilitate easier trade between member states, the reality is that countries such as Hungary and Slovakia are struggling to fully capitalise on these opportunities, the report adds. Improving logistical frameworks would open up significant opportunities for growth. Increased investment in digital infrastructure, better transportation routes, and streamlined customs processes could help CEE countries tap into the lucrative cross-border market.

Regulatory disparities, complex tax rules, as well as less developed delivery networks and e-payment systems all affect the customer experience and contribute to the region’s slower adoption of cross-border online shopping.

High inflation in CEE poses additional challenges to e-commerce growth. Poland, Romania, and Hungary are grappling with soaring costs, making it harder for consumers to spend on non-essential goods online. Rising energy prices and labour shortages further complicate the supply chain, driving up operational costs for e-commerce firms.

Nevertheless, some countries are seeing steady growth in e-commerce transactions, as businesses adopt strategies including localised payment solutions and a focus on essential goods.

Sustainability, regulatory pressures, but huge growth potential

The EU’s ambitious sustainability agenda is pushing CEE countries to align their e-commerce practices with strict environmental standards. Poland, Czechia, and Hungary, while embracing digital growth, now face the challenge of meeting EU regulations related to waste reduction, sustainable packaging, and circular economy practices. For small and medium-sized enterprises (SMEs) in the region, complying with sustainability regulations can be costly. However, businesses that successfully adopt sustainable practices stand to benefit in the long run.

Consumers in CEE are increasingly conscious of environmental issues, and companies that prioritise sustainability can gain a competitive edge in the market. While the transition to greener operations may be slow, it offers significant opportunities for businesses that are willing to innovate.

Despite these challenges, CEE holds tremendous potential for e-commerce growth, according to the report, and businesses that invest in technology, sustainability, and cross-border capabilities could capitalise on this. With the EU’s continued support through initiatives like the Modernisation Fund and the Recovery and Resilience Facility, CEE countries can look forward to a more connected and sustainable e-commerce future.

A mixed picture in Eastern Europe

Slovenia stands out in the Balkans for its advanced digital infrastructure and its increasing role in the regional e-commerce market. With high internet penetration rates and strong digital literacy among consumers, Slovenia has seen rapid online shopping growth. Cross-border trade is also flourishing, particularly with neighbouring Austria and Italy.

Slovenia’s focus on green energy and sustainable practices has positioned it as a leader in eco-friendly e-commerce in the region. However, more investment in logistics and payment integration is needed to maintain its upward trajectory, according to the report.

Albania’s e-commerce market is in its infancy, though it is experiencing rapid growth driven by increasing internet penetration and mobile phone usage. The country faces significant logistical challenges, with poor infrastructure and limited access to reliable delivery services.

Albania’s consumers are increasingly turning to e-commerce platforms for convenience, but cross-border shopping remains low due to limited trust in online transactions and a lack of payment solutions. As Albania works to improve its digital infrastructure, it is also focusing on integrating with broader European markets through EU support.

Still in the process of rebuilding its economy after decades of political and social instability, the e-commerce market of Bosnia and Herzegovina (BiH) remains underdeveloped, with low levels of internet penetration and significant logistical challenges.

BiH’s strategic location and desire to integrate with EU markets are driving efforts to enhance its digital capabilities, according to the report, which adds that investment in infrastructure and logistics is crucial for the country to tap into the regional e-commerce ecosystem. Cross-border trade is limited but offers significant growth potential if regulatory and trust barriers can be addressed.

Bulgaria, Croatia, Moldova growing markets with infrastructure challenges

Croatia’s e-commerce market has rapidly expanded over recent years, driven by its integration into the EU and improvements in digital infrastructure. The country has high internet penetration and a tech-savvy population, but logistical challenges and regulatory hurdles still pose significant barriers to cross-border trade.

The country’s location on the Adriatic Sea gives it access to wider European markets, but like many in the region, its SMEs struggle to adopt green practices and meet sustainability goals. The EU’s Recovery and Resilience Facility is expected to support Croatia in its digitalisation and sustainability efforts.

Bulgaria has both increasing internet penetration and a growing number of online shoppers. However, its potential is held back by inadequate infrastructure and a lack of integrated digital payment solutions. The country’s e-commerce market is largely domestically focused, though there is growing interest in cross-border trade, particularly with neighbouring Romania.

Like other CEE countries, Bulgaria faces challenges in meeting the EU’s sustainability benchmarks, but is making progress with government-led digital transformation initiatives to modernise the economy.

Moldova’s e-commerce sector is still in its early stages, limited by poor digital infrastructure and low levels of internet penetration. However, recent government initiatives and EU support have sparked growth for Moldova’s digital economy. Its e-commerce market is domestically focused, with only a small percentage of consumers engaging in cross-border shopping. Improving logistical networks and integrating digital payment solutions will be crucial for Moldova’s continued growth, ther report added.