CEE increasingly key to EU manufacturing - report

Central and Eastern Europe (CEE) is becoming increasingly vital to the EU’s manufacturing landscape, the German Marshall Fund of the United States writes in a new report entitled “Rethinking Industrial Policy for Central and Eastern Europe”.

Current industrial policies in the EU are pivoting towards high-tech, capital-intensive industries, as new regulations have relaxed state aid rules, enabling governments to offer substantial incentives to attract investors.

The report says CEE’s export-driven economies have integrated into this sector through significant foreign direct investment (FDI), primarily supported by EU funding mechanisms, including Cohesion Policy programmes aimed at regional and industrial development, alongside national state spending.

This shift, however, poses challenges for CEE countries, which often have limited fiscal capacity to match these incentives, the report adds.

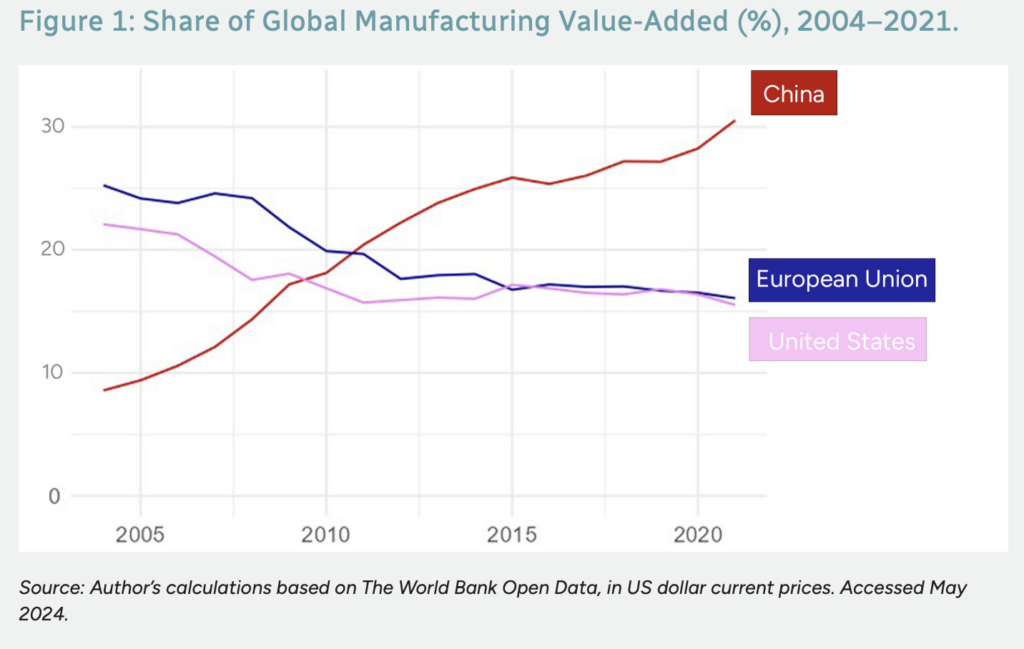

“The EU and the US have paved the way for a new economic policy paradigm for advanced economies through industrial policy. Questions surrounding strategic resilience, high stakes due to ongoing deindustrialization, foreign trade dependencies, and the global economic impact of the People’s Republic of China all have contributed to their renewed interest in industrial policy,” the report notes.

The Marshall Fund recalls that the US Inflation Reduction Act and the Chips and Science Act in 2022 prompted the EU to introduce the European Chips Act in 2022 and the Green Deal Industrial Plan in 2023. “These measures are their answer to Beijing’s industrial policy, and they aim to steer industrial development and green transition with a pinch of dirigisme,” according to the report.

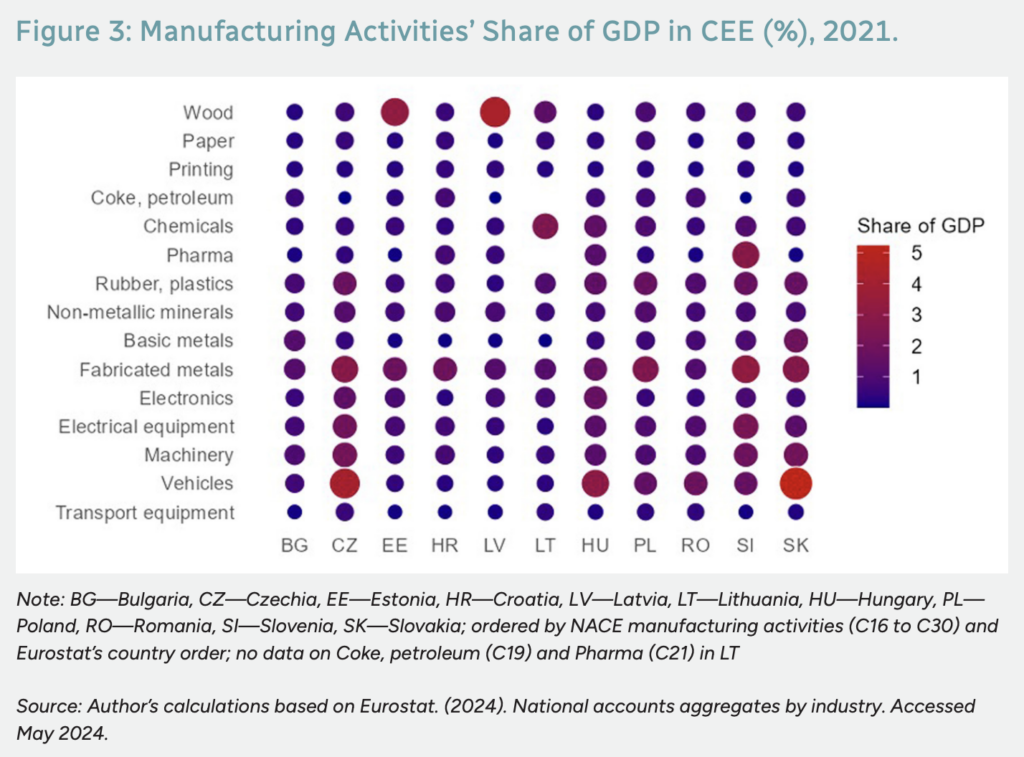

The report includes case studies on two critical industries in the region: batteries and semiconductors, focusing on their roles within the value chains of Czechia and Hungary.

Hungary growing hub for battery industry

The report says Hungary “has become one of the EU’s leading battery industry hubs and plays a key role in the drive toward self sufficiency in this field… principally through government spending on investment promotion.”

Hungary was fourth among lithium-ion battery exporters worldwide in 2022, with USD 5.1bn (EUR 4.75bn) in exports. In 2022, although battery-cell production supplied almost 25% of electric-vehicle production in the EU, 83% of these vehicles were manufactured in Western Europe, as was 85% of battery packs, the report notes.

Other key issues include the environmental sustainability of new investments, the decision to attract cheap foreign labour without any appropriate long-term policy, and the lack of knowledge spillover from multinational companies to SMEs to improve their value-chain position. New large investments announced by Chinese companies also raise geopolitical and security issues, the Marshall Fund adds.

Czechia pivots to semiconductors

With its broad innovation and R&D strategy and record low unemployment, the report notes, Czechia did not make attracting large investments a priority before the COVID-19 pandemic. “This has changed and its semiconductor industry is well-placed to draw in new investments in the micro- and nanoelectronics value chain.

“The country also has no battery strategy, although the Czech Battery Cluster was launched in 2022 with the support of CzechInvest, the investment promotion agency of the Ministry of Industry and Trade. The industry has grown rather spontaneously without government intervention.

“Czechia has started to support the industry through state aid for a handful of domestic and foreign companies, due to its strategic importance, its high value-added in production output, and the opportunity for stimulating R&D and high-skill employment,” the Marshall Fund comments.

The report asserts that CEE has transformed itself into a region with a solid manufacturing base in the two decades since eight members joined the bloc.

“Since 2004, the CEE countries increased their share of the EU’s manufacturing value-added by 60%, which today stands at 14%.14 In many aspects, the region has been considered de facto an integrated periphery of the EU in manufacturing, with an increasingly important role as a supplier of manufacturing inputs and final products to Western Europe and further afield. Manufacturing inputs play an even more critical role for the CEE economies than final products as they supply final producers worldwide,” the report underlines.

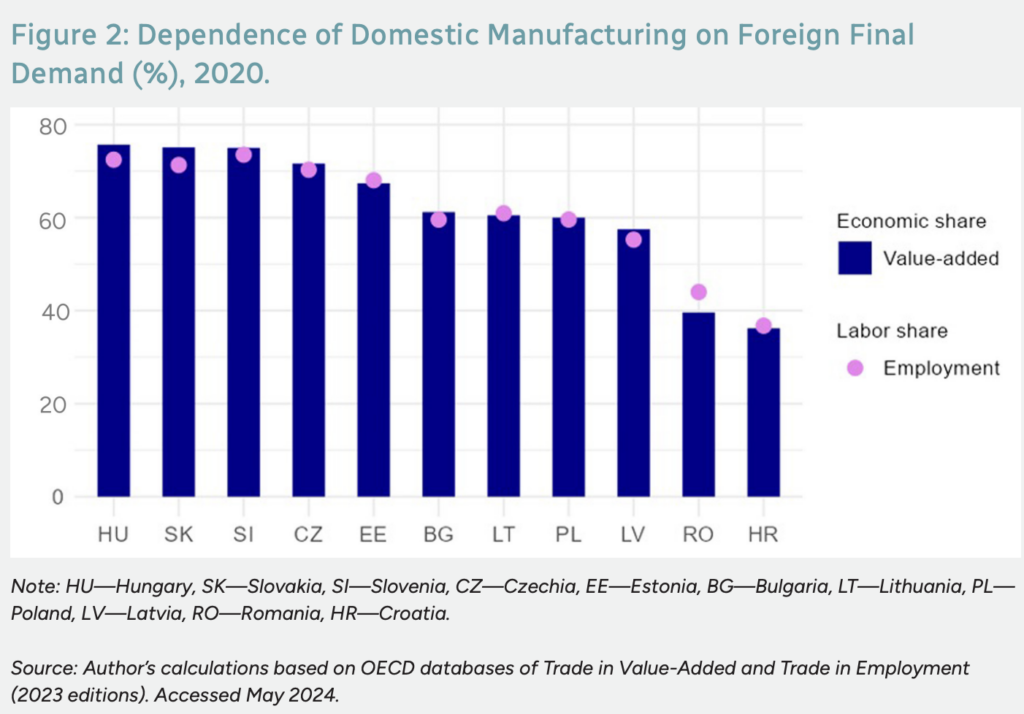

Manufacturing is not only essential for CEE economies: it is now fully integrated with Western Europe, the Marshall Plan asserts, adding that three points now stand out in this regard.

“First, manufacturing accounts for 20% of the CEE countries’ collective GDP, compared to 16% for the rest of the EU, with a relatively stable structure for almost 20 years. Czechia is the most industrialised CEE country and benefits highly from proximity to other EU markets, and particularly from close trade ties with Germany, the EU’s economic leader.”

However, the report notes, manufacturing share of GDP decreased from 2016-22 to record lows in the post-covid recovery in both countries: 23% in Czechia and 20% in Hungary.

Secondly, the report adds, “manufacturing comprises different activities and functions, including pre-production, fabrication, and post-production (but) higher value-added activities, including R&D, business services, and headquarters, are found outside the region”.

Finally, much of the value-added and employment in CEE manufacturing depends on foreign final demand as the result of export-oriented production, the Marshall Fund adds.

These case studies reveal key takeaways for CEE, according to the report. “First, industrial policy based on state aid in small open economies are costly and will not generate long-term benefits if it is oriented solely at production tasks as in the past. Investment must bring innovation and R&D. Second, CEE countries should make financing innovation and R&D the priority, not subsidizing new manufacturing projects. They should rationalize their policy objectives and update and stick to their national strategies.

“Third, tight budgets and financial consolidation put pressure on selecting projects for state aid. Governments should not provide this aid without a solid cost-benefit analysis of the investments. Fourth, the CEE countries should consolidate the too broad innovation priorities within their national strategies and analyse their long-term growth potential. Fifth, industrial policy must be accompanied by appropriate labour and education policies to support the green and digital transition,” according to the report.