CEE's nuclear dreams - CET analysis

The indispensability of nuclear energy was one of few areas of consensus at the recent summit of the strained Visegrad Four (Poland, Czechia, Hungary and Slovakia) in Prague on Tuesday, 27 February.

Over two years since Russia’s full-scale invasion of Ukraine, more and more countries in Central and Eastern Europe (CEE) are trying to move away from unilateral dependence on Russian nuclear fuel. Nevertheless, the sector is not without its problems.

Power plant construction lengthy, pricey

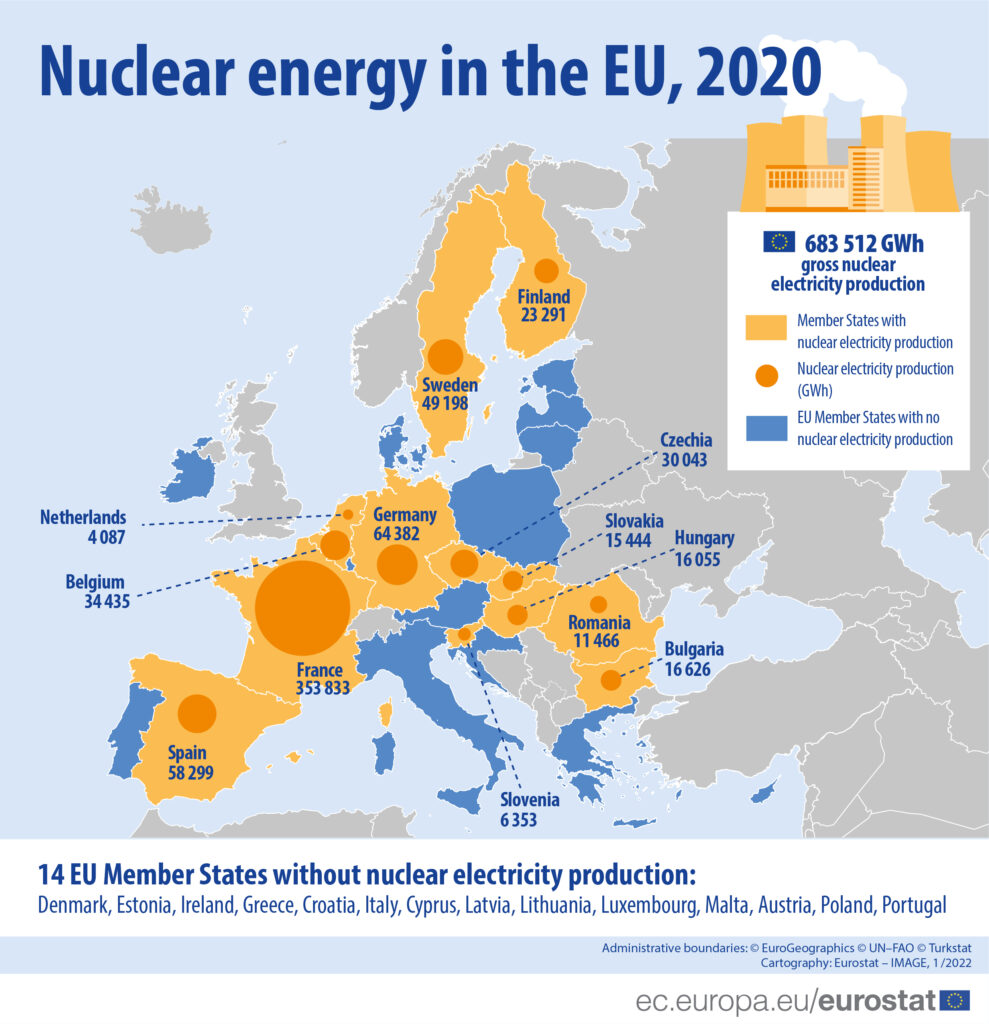

CEE’s nuclear-producing countries – that is Czechia, Hungary, Slovakia and Slovenia – have found building new nuclear power plants slow and expensive, while older units often face obsolescence.

Hungary’s only nuclear power plant in Paks, central Hungary, provides 35-40% of the country’s electricity, depending on the age and performance of the reactors.

Last month marked the tenth anniversary of an unanticipated report from the Russian news agency TASS that the Kremlin had signed a construction deal with the Hungarian government for Rostatom to build two 1,200MW reactors at Paks.

A further extension of Paks’s working hours is on the agenda, while preparations for the expansion are ongoing. Progress has been slow, however: under the 2014 agreement, the first reactor was meant to go live last year. The Paks permit issued before the last Hungarian parliamentary elections was merely a truncated version authorising earthwork and landscaping. For any further steps, new “retention point” permits are required.

In Finland, where Russian state company Rosatom had planned to build a nuclear power plant, the more transparent licensing process met the same compliance issues, to the point that the Finnish government eventually cancelled the contract, citing the war in Ukraine.

Back in Hungary, where the process has been more secretive, Russia’s design documentation seems to not fully comply with European regulations, and the key permit could not be issued.

US present in former Yugoslavia

Although Russia is not the sole nuclear power plant constructor, most CEE countries have Soviet-type power plants, except Slovenia, in the former Yugoslavia, which has a working nuclear reactor at Krsko, east Slovenia. Designed by US firm Westinghouse and operated jointly with Croatia, Krsko provides around one-third of Slovenia’s electricity.

The Slovenian Infrastructure Ministry has already issued a planning permit for a supplementary 1.1 GW unit at the efficient, high-capacity, and safe Krsko plant, which would produce 9 TWh of electricity annually for 60 years.

The operational life of the facility was originally set at 40 years but has undergone significant upgrades, including increased capacity and the replacement of key components. In mid-2015, Krsko received a 20-year operating time extension permit.

Slovakia, Czechia plan collaboration

Slovakia’s nuclear power plant at Mochovce, southwest Slovakia, is being expanded from two to four reactor units. The third block went online in 2023, while the fourth is planned for completion this year when it will supply 70% of Slovakia’s electricity. Construction costs exceeded original estimates, while delays occurred after the Slovak Nuclear Regulatory Authority found materials that did not meet European standards.

The country’s other nuclear power plant, in Jaslovske Bohunice, west Slovakia, with two operational V2 reactor units, earlier shut down its outdated and unsafe V1 units as a precondition for joining the EU. In November 2010 both reactors were upgraded from 440MW to 505MW gross electrical output, and their operation is planned to be maintained until next year.

There are also plans to build a V3 reactor unit at the site, the Slovak government jointly announced with the Czech energy company CEZ. According to plans, the reactor capacity could vary from 600 to 1,600 MWe, although the exact technical specifications have not yet been determined.

The project’s construction and completion dates are unknown and may depend on the shutdown of Temelin, south Czechia, one of the country’s two nuclear power plants, along with Dukovany, southeast Czechia.

As part of the expansion of the Dukovany power plant, new reactor units are planned to be built to replace the existing Soviet-designed units and to increase the proportion of nuclear energy. CEZ Energy Holding, which is majority-owned by the state, announced the tender for the expansion of the Dukovany nuclear power plant in 2022, with a new 1,200MW capacity reactor by 2036.

CEZ’s plans include the construction of three more nuclear reactors at the plants in Dukovany and Temelin but there is also talk of building smaller, modular nuclear power plants. In the case of Temelin, the previous plans included the construction of two new reactor units, the total capacity of which could have been up to 3,400MW.

However, CEZ announced in 2014 that it would suspend the project due to the lack of a government power purchase guarantee. Moreover, a global inflation-linked updated cost estimate remains unforthcoming from CEZ.

An interest-free government loan and electricity price fixing would be a possible route for financing, but long term this could affect consumers and impose a significant burden on taxpayers.

Other uncertainties have included financing, the complex environmental licensing process, and the issue of international safety standards tightened after the 2011 accident in Kyoto, central Japan.

Germany and Austria oppose plans to expand the Dukovany power plant. More and more CEE countries are trying to get rid of their unilateral dependence on Russian nuclear fuel.

Westinghouse and its Swedish subsidiary, with which Czechia and Slovakia are also negotiating the supply of heating elements, is CEE’s only non-Russian supplier of nuclear fuel for Russian VVER-440 and VVER-1000 reactors.

Westinghouse Electric and US engineering firm Bechtel are also working on CEE’s historical holdout country on nuclear energy, Poland, and last September announced their collaboration for the design and construction of its first nuclear power plant in Lubiatowo-Kopalino, Pomerania, north Poland.

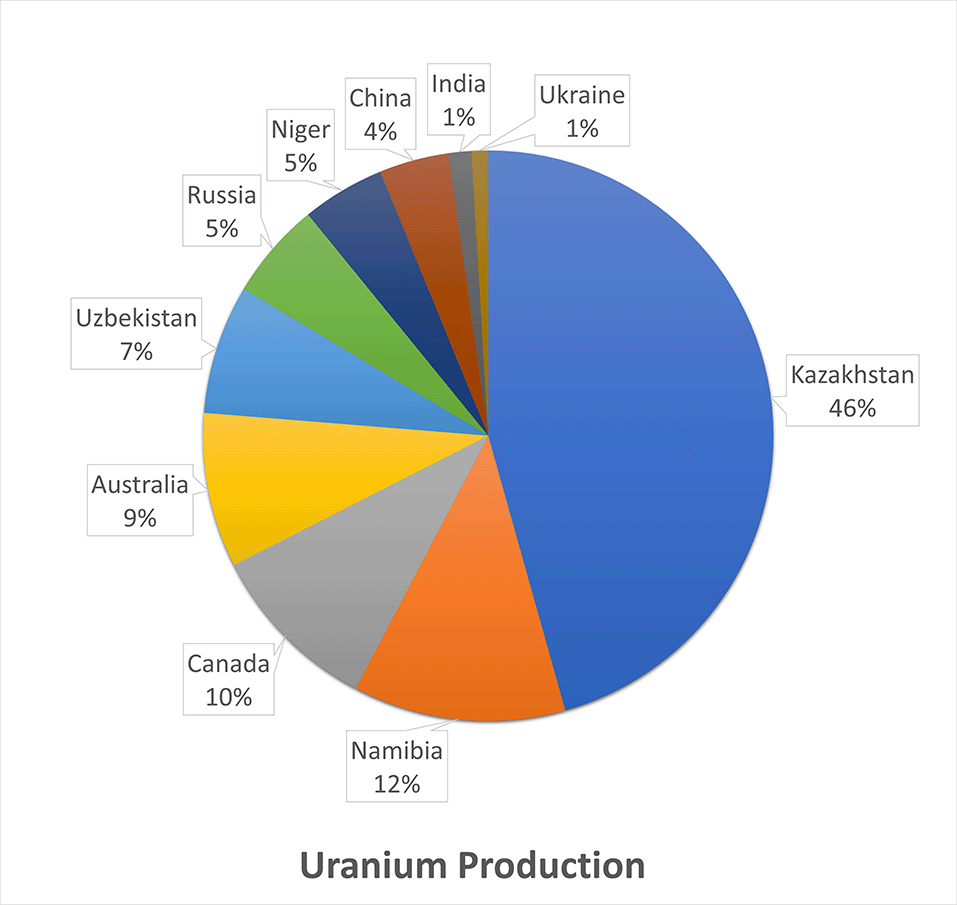

Ironically, Westinghouse relies heavily on uranium from Rosatom, mined in Kazakhstan and processed in Russia, mainly because of the extremely good quality and favourable price of Kazakh ore.

Hungary has reportedly chosen a different path and has started cooperation with French nuclear reactor company Framatome to develop fuel suitable for the Paks.

The French are not starting from scratch: when Framatome won an order in the early 2000s to clean the fuel cartridges in Paks – which incidentally became the worst level 3 nuclear accident in the plant’s history – the company gained knowledge now used in heating element manufacture.