Poland rapidly emerging as CEE powerhouse, top UK researcher reports

The emerging economies of Central and Eastern Europe (CEE) are closing in on their Western neighbours thanks to the emergence of new technologies, and nowhere more so than Poland, according to Britain’s oldest independent research institute.

CEE is likely to become a new centre of gravity of economic growth in the EU, the National Institute of Economic and Social Research (NIESR) found in its latest report, entitled “Prospects for Emerging Central and Eastern European Economies”. Their convergence is likely to accelerate due to its rapid increase in industrial activity and large foreign direct investment (FDI) inflows, the NIESR adds.

Growth in FDI, GDP encouraging for region

Forecasts for GDP growth in CEE countries are “very positive”, with analysts surveyed by Focus Economics anticipating growth of 0.8% this year and 2.8% in 2024 – nearly three times higher than the projected 1.1% for the Eurozone as a whole.

Among CEE countries, Poland, Romania, and Hungary are anticipated to enjoy the greatest growth trajectory, having most adeptly navigated the challenges posed by the COVID:19 pandemic and energy crisis, the NIESR writes.

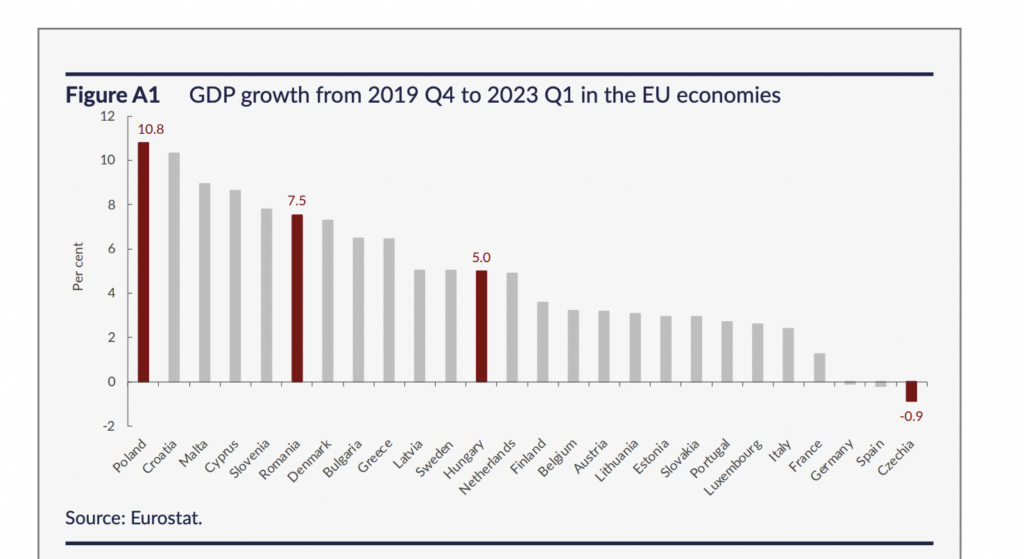

Poland, for instance, has enjoyed an “impressive” 10.8% GDP expansion since the final quarter of 2019, second only to Ireland in the EU, according to the UK research institute.

Romania and Hungary have also demonstrated solid performances, achieving growth rates of 7.5% and 5% respectively, surpassing the EU median and are expected to maintain “robust” growth in the years ahead, the NIESR adds.

Conversely, Slovakia and the Baltic States of Estonia, Latvia and Lithuania, exhibit comparatively modest growth, recording approximately 3% growth since the pandemic—a performance akin to Western economies such as the Netherlands and Italy.

Czechia is presently the weakest performer in CEE, and is still struggling in its recovery from the pandemic, and the consensus is that it will be the regional laggard for growth in 2024.

Poland fifth in world for EV batteries

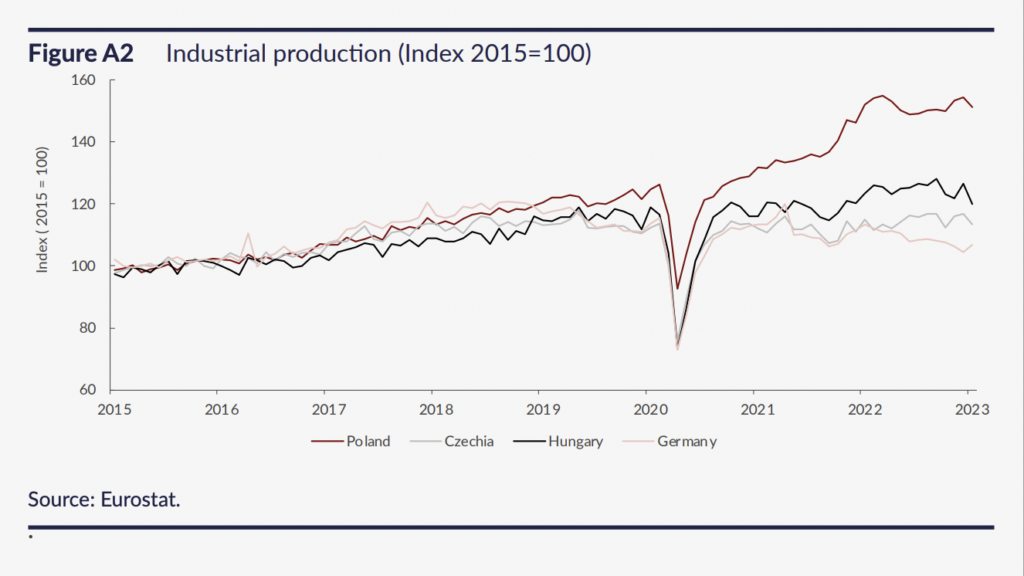

The high-tech manufacturing sector has demonstrated similar growth patterns, with notable specialisations in several sectors. Poland, for instance, has emerged as the world’s fifth-largest producer of electric vehicle batteries, with exports totalling EUR 6.5bn in 2021.

Poland currently has 6% of EV global capacity and the 2nd largest volume of exports worldwide, according to the Polish Alternative Fuels Association (PSPA). CEE has also benefited from investments in electronic component production and the heat pump industry, contributing to industrial growth and prosperity.

Industry driver of growth in CEE

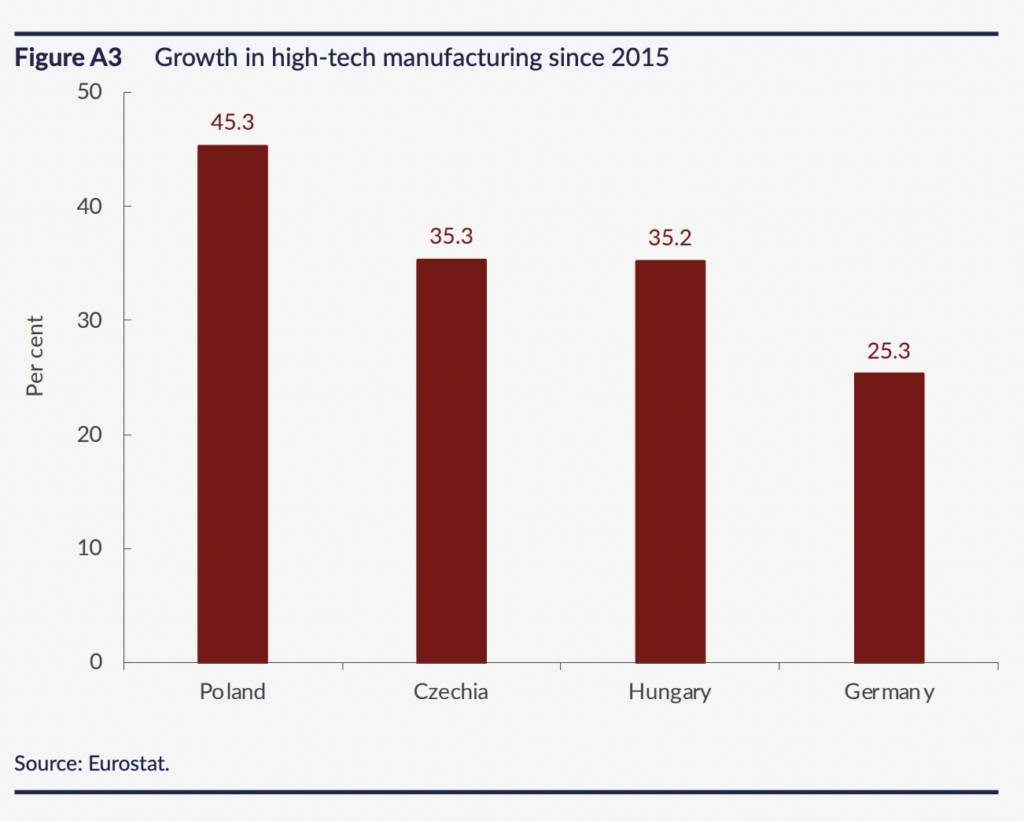

The robust economic performance of leading CEE countries can be attributed to a substantial upsurge in industrial activity, the NIESR writes. Countries in CEE have experienced a surge in industrial production driven by robust foreign demand and investments, offsetting slower domestic consumption growth.

Poland has witnessed industrial production increase by over 51% since 2015, followed by Hungary with a 20% increase and Czechia with a nearly 10% rise. In contrast, Germany, considered Europe’s manufacturing powerhouse, has experienced relatively stagnant industrial production in the last seven years. The growth in production volumes in CEE is directly attributable to advancements in supply chain capabilities, the researcher adds.

Furthermore, Poland has experienced substantial growth in solar energy installations, with a 500% increase compared to pre-pandemic levels, supported by subsidies and household demand. The country is also advancing in its pursuit of nuclear energy, planning large-scale plants and exploring small modular reactors.

Renewables offer new opportunities

CEE could reap benefits from energy transition initiatives, as Poland and the Baltic States expand their maritime infrastructure for LNG and oil imports, aiming to reduce the EU’s reliance on Russia. The oil terminal in Gdansk, northern Poland, already serves neighbouring countries.

Hungary, reliant on Russian oil and gas imports, is extending the use of its nuclear plant in Paks, central Hungary, and focusing on renewables. Increased use of renewables in both Poland and Hungary necessitates investment in power grids and pumped-storage hydroelectricity for a stable energy system, creating investment opportunities in areas requiring specialized expertise.

Poland increasingly popular for industry

Poland has emerged as the EU’s second most favoured destination for industrial plants, after Germany, and is also a preferred location for European companies engaging in sourcing and reshoring activities, the NIESR adds, citing surveys by news agency Reuters and international logistics operator Maersk.

Czechia and Romania, have experienced weaker performances and rank lower for FDI. Poland enjoyed FDI inflows of over 5% of GDP in 2022, nearly double the historical average. While some of this increase is attributed to reinvestments by multinational companies already operating in CEE, a noticeable inflow is also observed in the corporate debt market, the NIESR adds.

Despite slower progress in other regional countries, these results are still favourable, particularly given the proximity of the conflict in Ukraine. The majority of companies chose to reinvest their profits, contrary to earlier predictions of capital outflows from CEE when the conflict began. The trend of reshoring and investment underscores the continued attractiveness of the industrial sector in CEE, with ample growth potential.

Military spending also boosts Polish economy

Military expenditure is expected to provide short-term support to industrial capacity, particularly in Poland, where military spending as a percentage of GDP is the highest within NATO, at 4%. Other CEE countries allocate around 2-2.5% of their GDP to military spending.

While Poland’s higher expenditure could facilitate technology transfer and attract US-based investment, it also brings a higher budget deficit. Although Poland managed to limit government borrowing to 3% of GDP last year, analysts predict that Poland will exceed the EU’s Excessive Deficit Procedure threshold in the next two years. Although the short-term impact is predicted to be manageable, addressing the deficit through increased taxation could pose a downside risk to long-term economic growth.

Employment rates of Czechs, Poles problematic for labour market

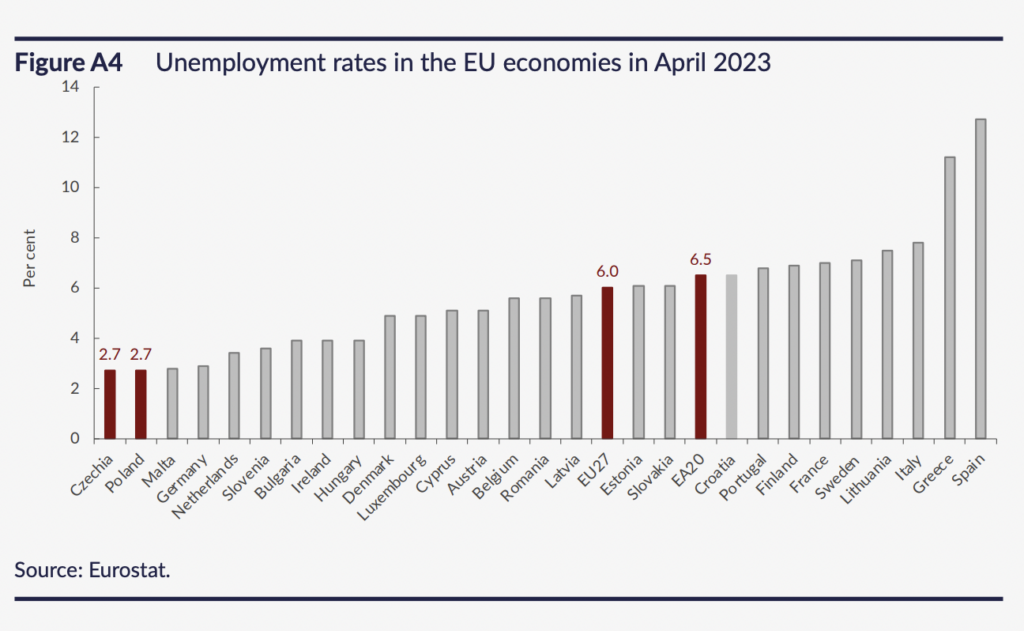

The labour shortage poses a challenge to economic growth in Czechia and Poland, both of which boast some of the EU’s lowest unemployment rates (2.7%), the NIESR writes.

The monthly European Commission business survey found that businesses in these countries are struggling to find workers. Several trends could help mitigate this challenge: rising labour market activity and involvement in economic activities, the potential for productivity gains through digitisation, and the adoption of robotics and technology.

Ukrainian refugees boost economies

Immigration measures have been introduced by CEE governments to counter the labour shortage, particularly in attracting immigrants from Ukraine. Since the conflict in Ukraine, over a million people have arrived in Poland, while nearly 500,000 have settled in Czechia.

The Polish government has extended similar rights to Ukrainian workers as Polish citizens, leading to small businesses being established by Ukrainian immigrants, spanning a range of sectors including programming, technical firms, and manufacturing engineering services.

Focus Economics analysts predict unemployment rates to increase by less than 1 percentage point across the region, with Hungary, Czechia, and Poland experiencing modest increases. Notably, Poland is seeing fewer company group layoffs compared to 2022, indicating a relatively stable labour market despite economic challenges. Tight labour markets in CEE are driving wage-led inflation. Inflation has already peaked in most CEE countries, with Hungary experiencing the highest price growth at 20% year-on-year to May, the NIESR adds.

The NIESR was founded in 1938 by a group of social and economic reformers including John Maynard Keynes and William Beveridge.