New MOL oil well in west Hungary ups domestic output

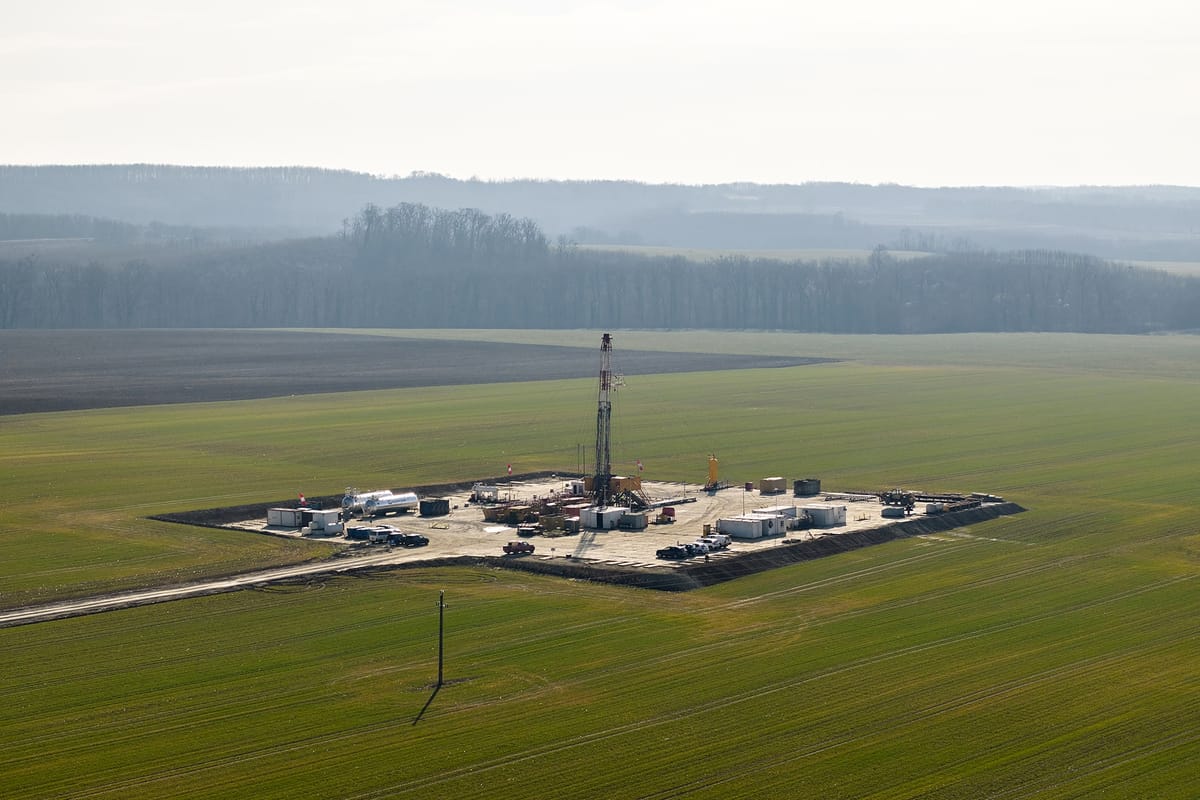

MOL has begun production of 1,200-1,400 barrels of oil per day (bpd) at its Som-8 well near Somogysamson, west Hungary, following first oil in March. The Hungarian energy company is meanwhile drilling a deeper Som-7 appraisal to assess extra reserves and increase domestic supply.

Hungary's first new domestic crude of the 2020s

The discovery is the first commercial oil strike of the decade in Hungary’s Transdanubian basin. National demand averaged 167,000 bpd in 2024, while domestic crude output was around 22,000 bpd, or 37,00 bpd including liquids and gas, according to industry data.

If Som-8 holds steady and the deeper Som-7 appraisal well succeeds, total production could rise to around 25,000 bpd. While this would still only cover 14-15% of demand, it would represent a boost to Hungary’s output.

Som-8 tapped a fractured dolomite reservoir 1.25 km below ground. Drilled in late 2024, it reached target depth in just over a month. The structure is believed to be around 100 million years old, and its reservoir temperature exceeds 50°C, indicating stable energy levels.

“MOL keeps uncovering previously unknown hydrocarbon pockets and further strengthening Hungary’s security of supply,” MOL executive vice-president for exploration and production Zsombor Marton said in March.

Transit to MOL refinery in Szazhalombatta

Barrels are being trucked 170km north to MOL’s Danube refinery at Szazhalombatta, which can process 162,000 bpd. Som-7 is targeting 1.5 km depth and is expected to reach it by mid-June.

MOL has not released a recoverable reserve figure. Analysts say the structure likely holds “single-digit million barrels” at best. Commerciality will depend on log results and pressure testing from Som-7 later this summer.

MOL’s Budapest-listed shares traded around HUF 3,100 last week, just below their May peak. Analysts at Wood and Company and Concorde Securities called the Somogysamson flow “symbolic rather than transformative” for earnings.

Imports dominate Hungary’s oil balance. Russian crude covered 86% of the supply in 2024, up from 61% in 2021. Hungary continues to receive oil via the Druzhba (Friendship) pipeline under an EU sanctions exemption.

Few regional alternatives to Moscow oil

The Energy Ministry called the Somogysamson volumes “a strategic buffer”. Environmental groups disagreed. Greenpeace Hungary expressed concerns about the environmental impact of continued fossil fuel reliance.

MOL plans to invest HUF 150bn (EUR 99mn) in domestic exploration and production over the next five years. Yet pipeline capacity on Croatia’s Jadranski naftovod route remains tight and Slovakia relies on Russian crude almost as heavily as Hungary, leaving Central Europe vulnerable until alternative supply channels expand and refiners adapt.

Capacity on Croatia’s JANAF pipeline has been been restricted by bilateral tariff disputes. Meanwhile, Slovakia remains similarly dependent on Russian crude. Budapest has criticised repeated fee hikes along the Adriatic route.

A 4–5 million tonne per year pipeline from Serbia is awaiting a final investment decision in late 2025. MOL also renewed a one-year, 2.1 million tonne import agreement with JANAF in March.

Erste Bank energy analyst Andras Pletser said the new flow was “a drop in a Russian-coloured bucket”, underlining Hungary's need to diversify more broadly.

Logging results from Som-7 are due mid-June. If they confirm productivity, MOL is expected to drill two additional step-out wells in Q4.

MOL COO Gyorgy Bacsa said Hungary, as a land-locked state moving crude largely by pipeline, “must reduce import dependence by every available means” and that MOL would continue to invest with this rationale.