Estonia dominates top-30 regional startup list

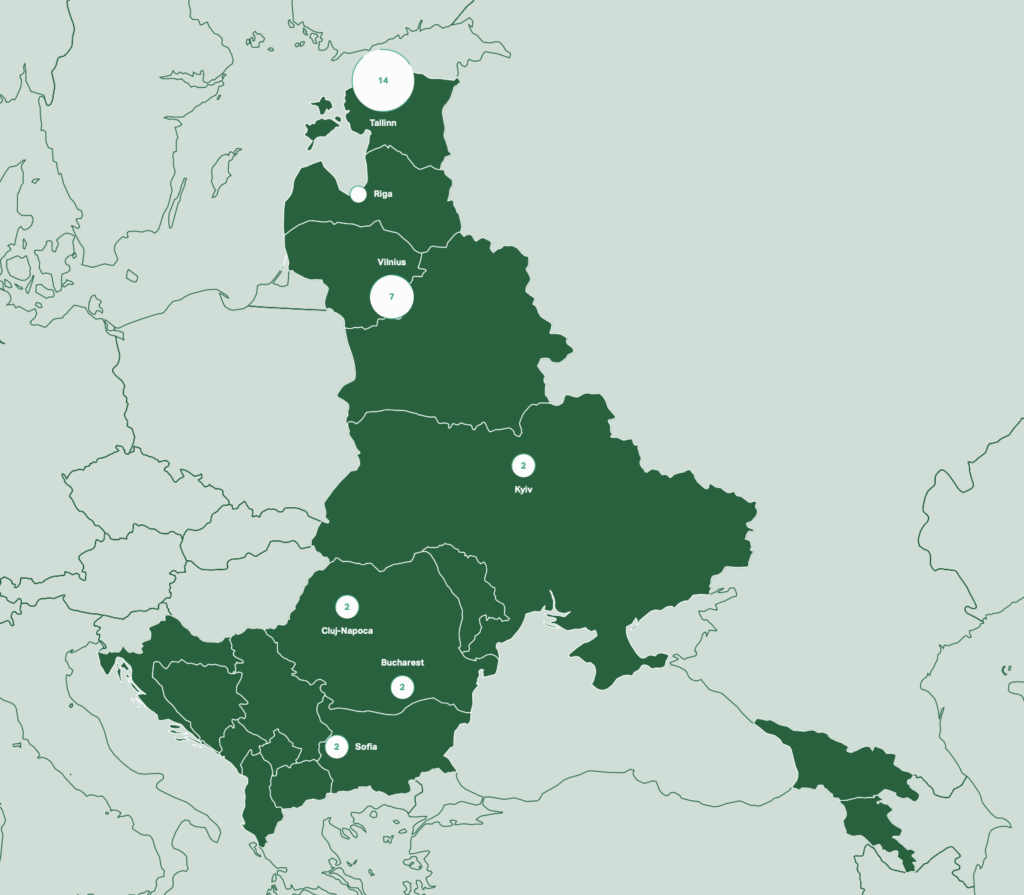

A new list spotlighting the fastest-growing startups in Central and Eastern Europe (CEE) shows Estonia as the clear leader in the region’s startup scene, with neighbours Latvia, Bulgaria, Romania, and Lithuania also making the leaderboard.

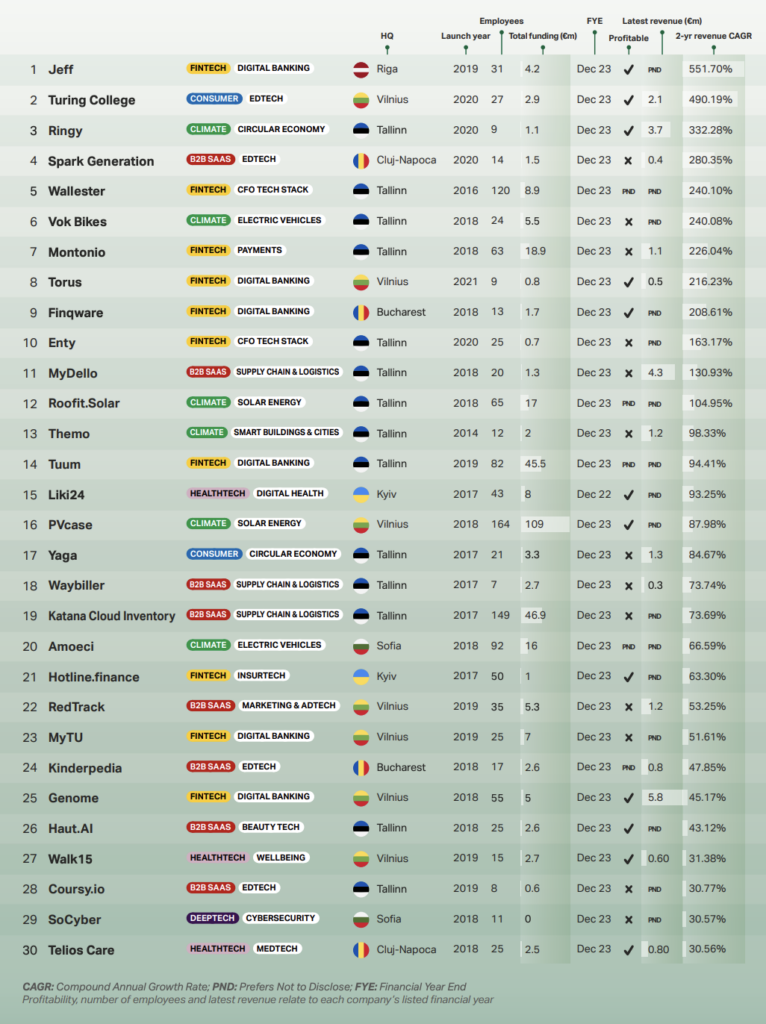

The Sifted 30: Eastern Europe & Baltics leaderboard ranks private startups established within the last decade based on percentage-revenue growth over the previous 3 years.

Estonia sets the pace in Baltic innovation

Estonia occupies nearly half of the spots on Sifted’s list, which also researched startups in Ukraine, Latvia, Lithuania, Belarus, Moldova, Armenia, Georgia, Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Kosovo, Montenegro, North Macedonia, Romania and Serbia.

The Baltic country’s status as a tech hub traces back to the “Skype effect”, a phenomenon where alumni of the digital telephony pioneer went on to create a thriving startup culture in Tallinn. Estonia’s favourable digital infrastructure—supported by initiatives including e-residency and online voting—has built a collaborative ecosystem that attracts entrepreneurs.

Startups also benefit from a culture of mentorship, which CEO Taavi Tuisk of Ringy, a top-ranked startup trading refurbished electronics, said allows founders to learn from each other’s mistakes. All these startups should show gratitude to “the Skype guys”, Tuisk told Sifted in an interview.

Sifted adds that Skype is “the agreed-upon starting point when describing Estonia’s success, with the well-known story of how an internet call company led to the creation of lots of new companies—many of them with Skype connections—and created one of Europe’s most energetic tech clusters in the process.

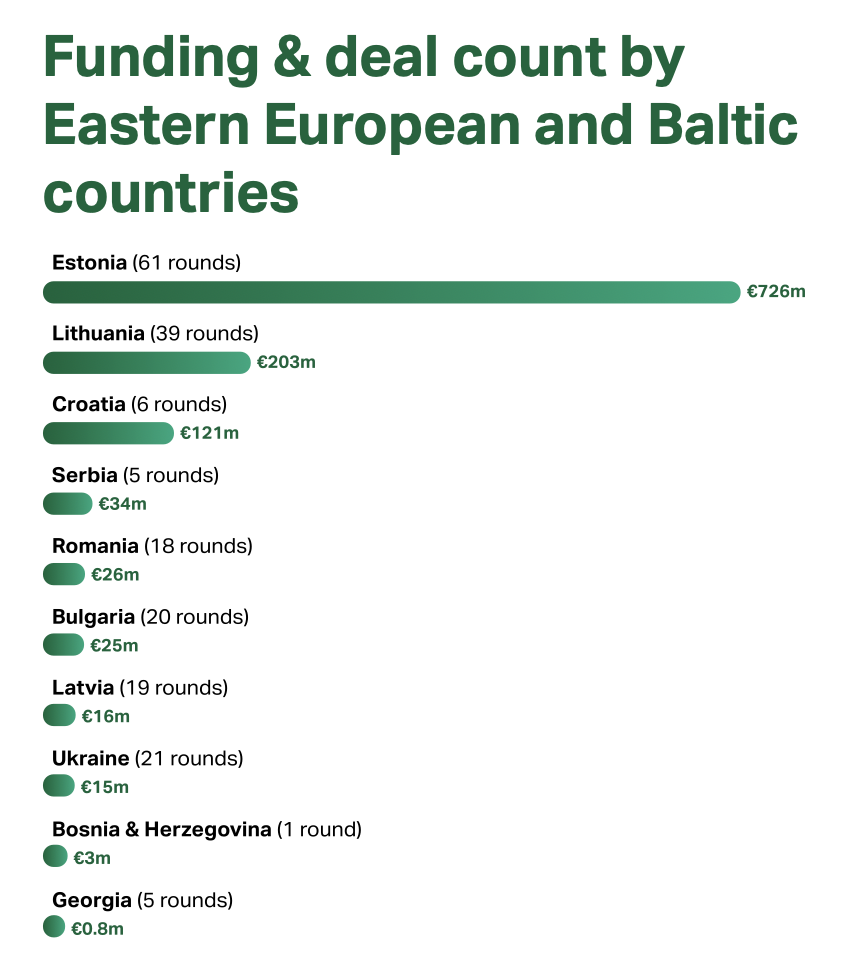

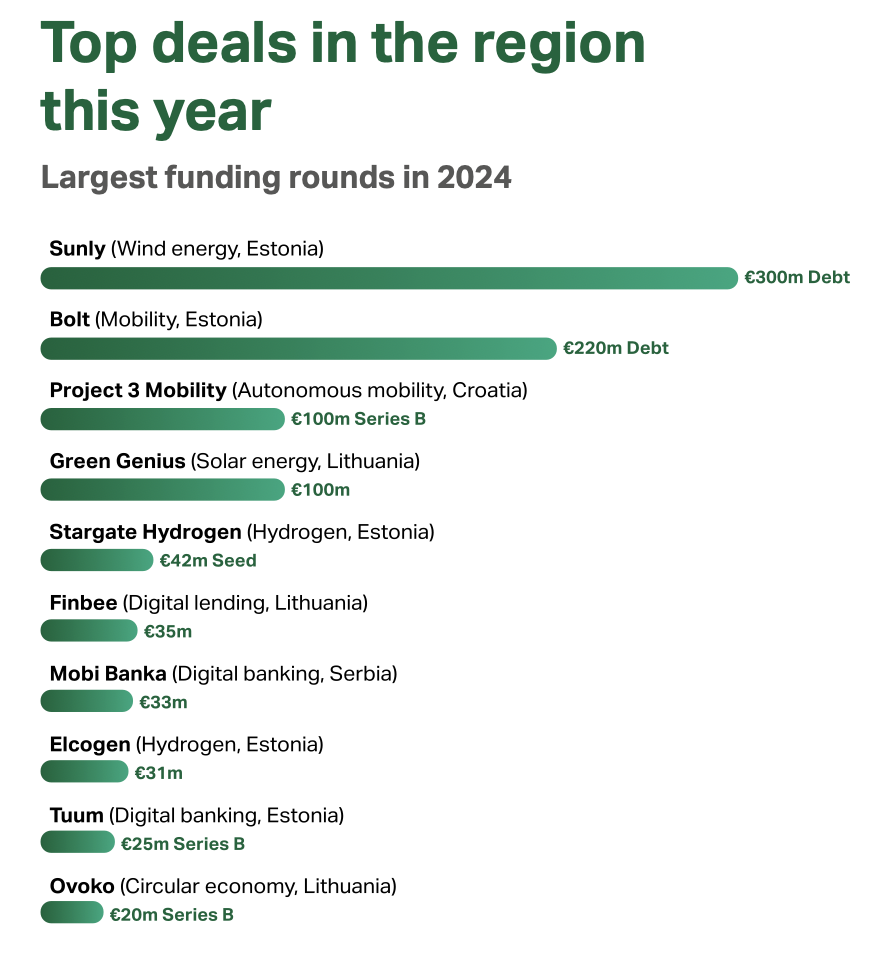

“The country of 1.3m people has produced 10 unicorns, including fintech Wise — which relocated to London— Uber rival Bolt and software companies Pipedrive and Veriff. The two biggest tech deals in Eastern Europe so far in 2024 — EUR 300m raised by renewable energy provider Sunly and EUR 220m by Bolt — were both signed in Tallinn,” Sifted adds.

Lithuania: cultivating tech talent for future growth

With companies such as Vinted, PVcase, and Nord Security, Lithuania’s tech sector is expanding despite the country’s population of 2.79mn population. Capital city Vilnius has promoted itself as a tech destination with campaigns including last year’s “Got fired by Meta or Twitter? Move to Vilnius” that targeted workers in cities including London, UK.

Meanwhile, education technology startup Turing College, ranked 2nd on the Sifted 30, is training local tech professionals. Recent high-profile funding rounds, such as Vinted’s EUR 340mn share selloff, suggest that Lithuania’s tech ecosystem is growing, Sifted writes.

Latvia: a quiet startup scene seeking momentum

Latvia’s startup scene is smaller, with tech companies raising only EUR 16mn in 2024 compared to Estonia’s EUR 726mn. Despite big investments in past years—such as EUR 50mn for Printify and EUR 30mn for Aerones—the country still lags behind its Baltic peers.

Jeff, ranked top and the only Latvian startup on the Sifted list, builds alternative credit scores for “‘underbanked’ people in emerging economies” and plans to expand into countries including India, Mexico and Indonesia. “There are still plenty of places in the world where people have hardly any financial records and so can’t easily open bank accounts,” Jeff CEO Toms Niparts told Sifted in an interview.

Meanwhile new initiatives such as Startup House in Riga are aiming to foster a tech community by offering coworking spaces and networking opportunities.

Bulgaria: deeptech ambitions face hurdles

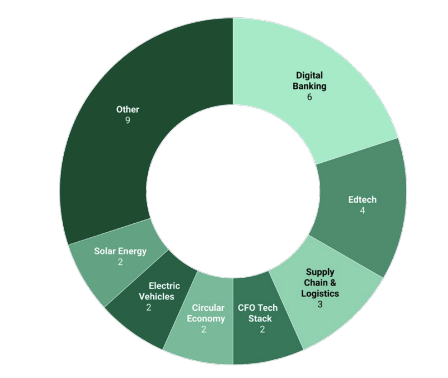

In Bulgaria, attracting investment for deeptech and biotech ventures remains a major challenge, as most venture capital still favours software and IT sectors.

Sofia-based Nasekomo, an insect-rearing tech firm, exemplifies these struggles, Sifted writes: while it secured an EUR 8mn round in early 2024, finding further funding has proven difficult. According to co-founder Xavier Marcenac, the weak investment climate for deep-tech companies has been compounded by political instability, shaking investor confidence.

Romania: building on UiPath’s success story

The Romanian startup scene has transformed in recent years, catalysed by the success of UiPath, which IPOed in New York in 2021, according to Sifted, and the workplace automation firm’s influence has paved the way for other startups, such as FlowX and FintechOS, to attract investment.

Low operational costs and a deep talent pool make Romania attractive for tech firms and fuel homegrown innovation, and 4 Romanian firms, including education platform Spark Generation, made this year’s Sifted 30, showing the increasing diversity of CEE’s ecosystem.

Regional outlook: facing growth, structural hurdles

“These countries differ greatly, each offering distinct advantages and challenges to investors and founders,” Sifted writes, adding that “some are EU members, which grants them access to the single market of 27 countries. With a shared history rooted in communism, these markets also have certain commonalities. Technical skills and maths were traditionally prioritised in Soviet and post-Soviet educational systems, resulting in countries filled with exceptional tech talent — often at lower wage levels than in Western Europe.”

Tech startup founders from CEE have “historically struggled to get attention and capital from investors as local venture markets are still developing. As a result, startups in the region are often forced to bootstrap and focus on profitability from day one — a quality that, today, is highly valued by investors,” Sifted adds.

Next Baltic unicorn could come from defence sector

An Estonian defence-focused startup SensusQ, which secured EUR 3.8mn from VC firm New North Ventures in June, hints at the future direction of regional startups.

“Makers of military drones—tech that’s cheap and is having an outsized impact in Ukraine—are also among the big winners of increased investment. Riga’s Origin Robotics announced a EUR 4mn raise in October for its drone-mounted precision-guided weapon system,” Sifted writes.

These rounds are relatively small; a tiny fraction of the total sum raised by Europe’s frontrunner defence company, Helsing, an AI-based tech firm in Munich, which announced a EUR 450mn round earlier this year. “It is likely that the next Baltic unicorn could emerge from defence,'” Agris Kipurs, cofounder and CEO of Origin Robotics, told Sifted.