Auto sector slides down large company list - Coface CEE Top 500 study

Automotive and Transport has dropped to third place amongst large companies in CEE, as business sectors of Central and Eastern European (CEE) shifted in size, partly due to soaring commodities prices, the latest Coface CEE Top 500 study found.

In its 15th annual study, the French insurance company collects data on CEE’s largest businesses’ turnover, payrolls and frameworks. The report serves “as a representative indicator of the market trends throughout the entire region”, according to Coface.

In 2022, the overall turnover of CEE’s top 500 companies surged by 39.8% to EUR 1.1tn, reflecting substantial growth. CEE economies have demonstrated resilience to the Ukraine war but gradually slowed due to rising costs and energy issues, according to the study.

Competition for the top positions has intensified, Coface writes. “In our 2010 edition of the CEE Top 500 companies, the minimum revenue for a company to qualify for the ranking was EUR 354mn, but this has more than doubled to EUR 710mn this year.”

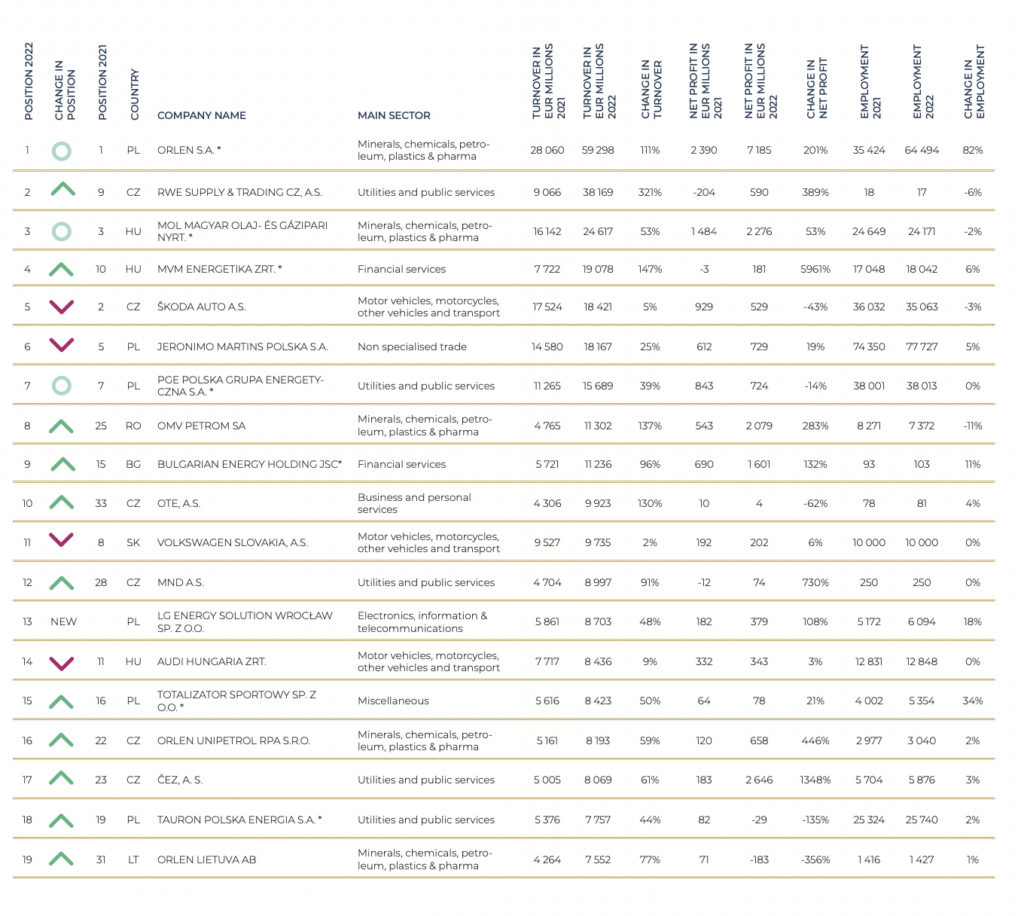

The top seven companies all retained their positions on the Coface CEE Top 500 from the previous year. PKN Orlen remains top after a 111% increase in turnover, in the wake of a 52% rise the previous year. Czech RWE is second, the multinational oil and gas company MOL Hungary third, Hungarian MVM Energetika fourth, Czech Skoda Auto placed fifth, retailer Jeronimo Martins Polska in sixth and Polish energy company PGE in seventh place.

All of these companies recorded higher turnovers, while electricity trading companies such as RWE and MVM reported triple-digit revenue growth. The automotive sector was less represented in the top ten this year.

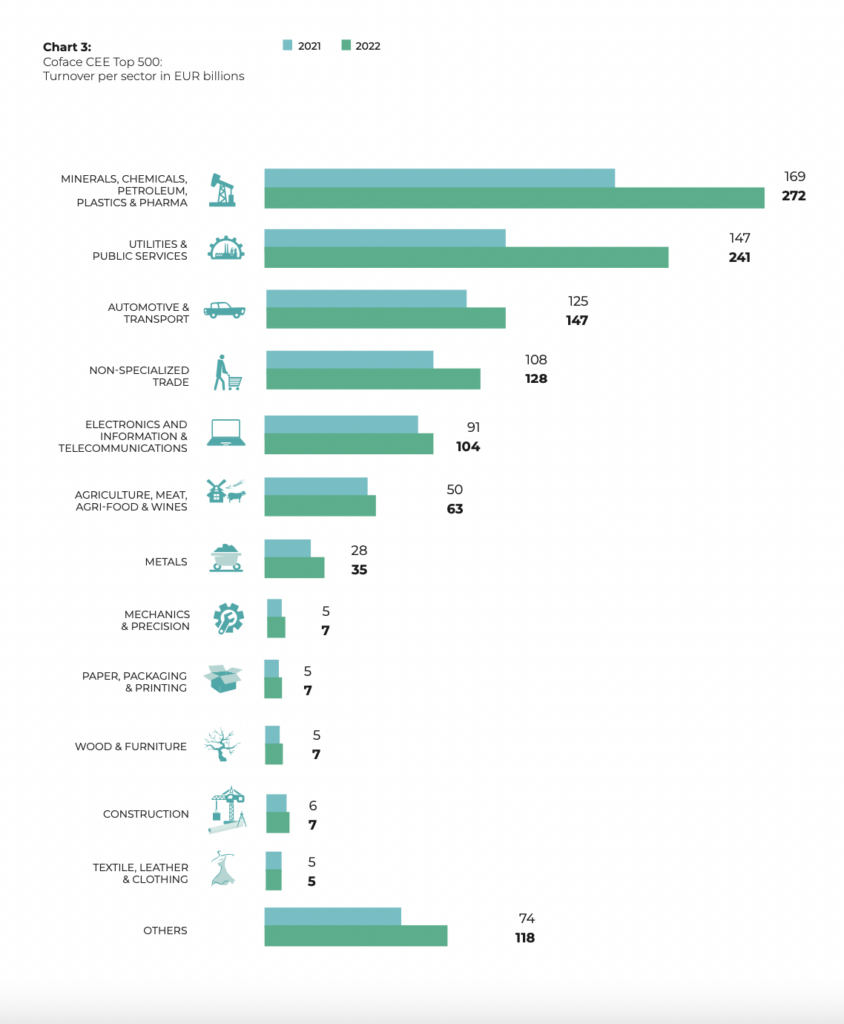

Every sector records growth

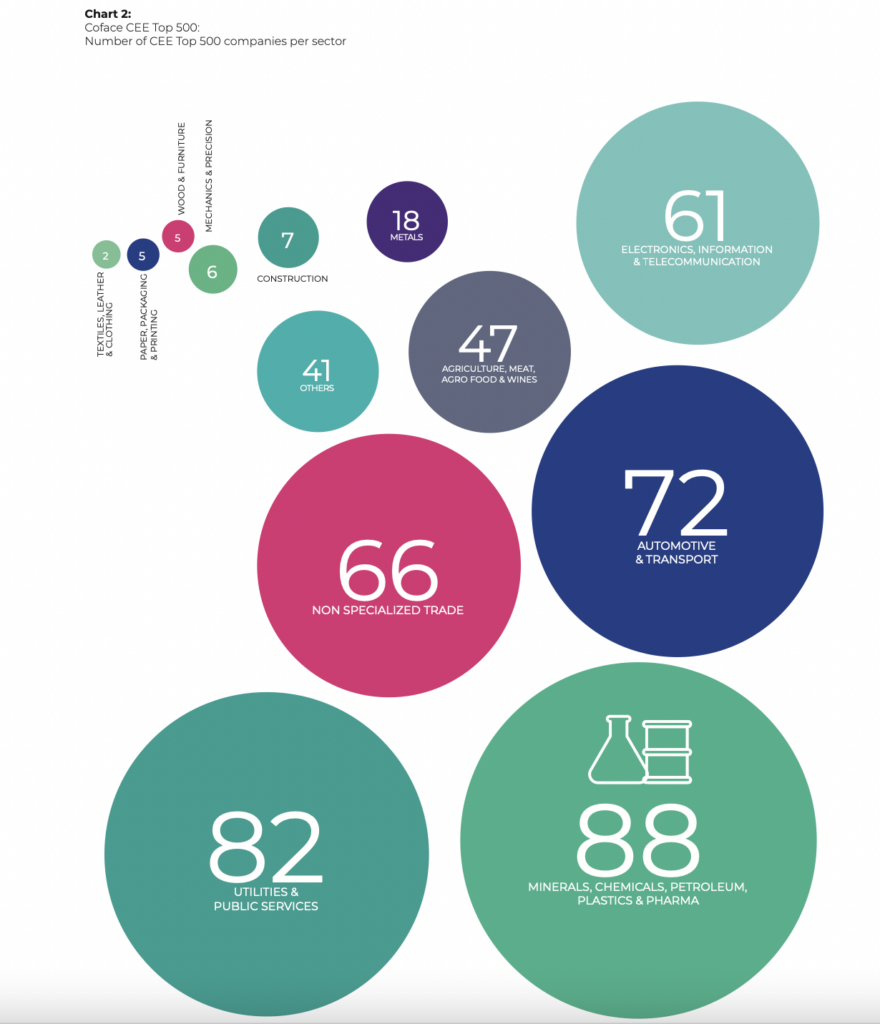

Automotive and Transport has struggled in recent years, as a post-pandemic rebound drove up prices. This year 50 companies from the sector slipped down the Coface list, as sales of new passenger cars fell 4.6% in the EU, mainly due to supply constraints. The Top 500 includes 72 Automotive and Transport companies – down 5, despite 10 new entries. The sector makes up 14.4% of the Top 500 list.

The Utilities & Public Services sector moved up from 4th to 2nd place and increased its number of companies listed by 15. Turnover amounted to EUR 241.3bn, up 64.1%, as net profits rose by 68.3%. The sector held the highest shares in Croatia (53.8%) and Czechia (40.7%). The top ten placed companies include Czechia’s RWE and Poland’s PGE.

The Minerals, Chemicals, Petroleum, Plastics & Pharma sector has traditionally been the largest sector, and this year it has 3 representatives in the top 10: Poland’s PKN Orlen, Hungary’s MOL and Romania’s OMV Petrom.

The sector’s turnover rose by 60.9% in 2022, holding on to the top spot, thanks to the EUR 272bn aggregated revenues of 88 companies, or 18% of the Top 500. The sector registered the highest surge in net profits, by 100.5%, as its number of listed entities increased by 3.

All 13 sectors recorded upticks in turnover. Utilities & Public Services and Minerals, Chemicals, Petroleum, Plastics & Pharma recorded growth of 64.1% and 60.9% respectively. The only sector not to post double-digit growth in turnover in 2022 was Construction (up 8.1%).

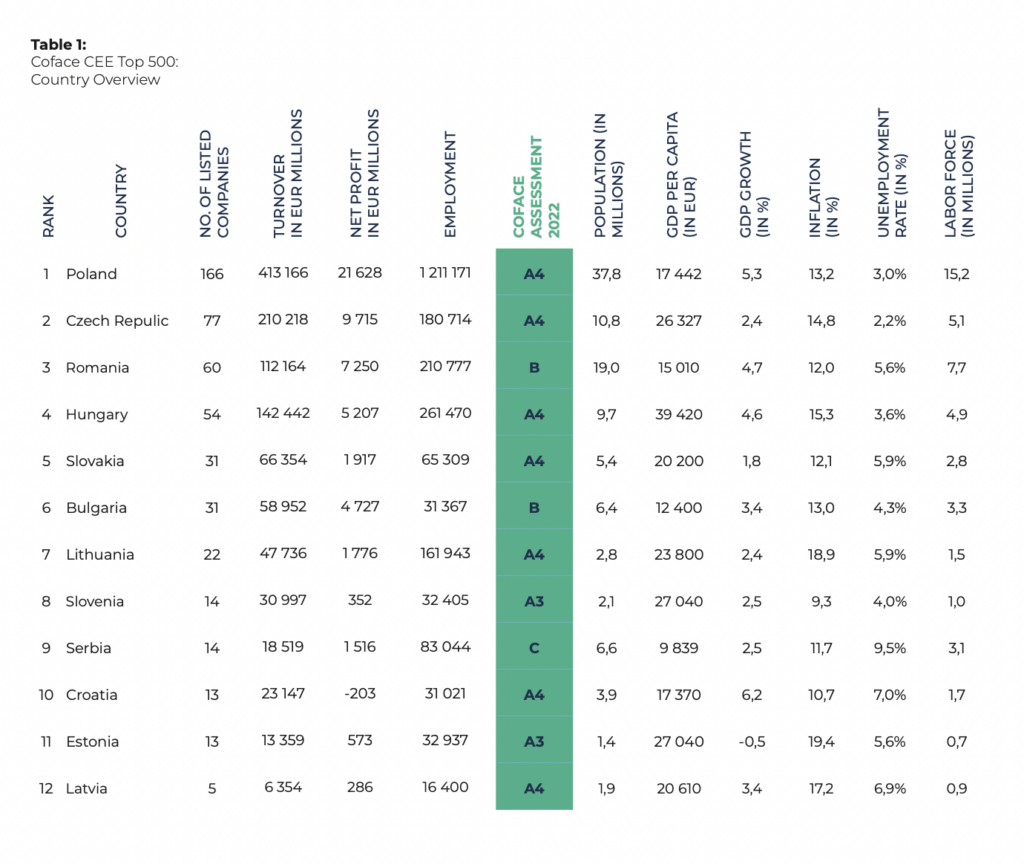

Poland dominates, Romania overtakes Hungary

As well as being CEE’s largest and most populous country, Poland has the region’s most diverse industrial structure and many of its large businesses. As GDP grew 5.3%, Poland supplied 28 of this year’s 166 list entrants.

In Poland, Minerals, Chemicals, Petroleum, Plastics & Pharma still has the largest turnover of 27.2%, as aggregated revenues hit EUR 413.2bn and net profits climbed 38.6% to EUR 21.6bn. Automotive and Transport is the sector with the most Polish companies (15.1%).

The study also assesses companies on a scale of 0-10 on probability of default within 12 months, with the average score in the EU a low risk 6.4. Only 2% of the companies scored 3 or lower, which indicates a very high risk.

Coface scores Poland’s average value as 6.1. The best rated on average are Czech and Slovenian companies with 7, while Estonian firms rank last, with 4.7.

Czech still second on podium

Czechia remains in second place. Despite shedding 15 companies last year, 77 firms generated an aggregated turnover of EUR 210bn, up 33%, as net profits soared by 103.7%.

Skoda Auto generated EUR 18.4bn, or nearly half of Automotive and Transport’s EUR 38.3bn turnover, which itself comprises 18.2% of the country’s Top 500 total. Utilities and Public Services also have a 18.2% share in Czechia.

Around 19% of the companies that fell out of the Top 500 in 2022 were Czech, the highest ratio of any country.

Romania, Hungary swap places

Romania overtakes Hungary to move into third place, with 60 companies, up 1, in the report. Turnover of Romanian firms rose by 44.1% to EUR 112.2bn, while net profits jumped most of any country on the list, by 142.5%. With 32% of turnover, Minerals, Chemicals, Petroleum, Plastics and Pharma is the biggest sector among large Romanian companies. The next most represented sectors are Utilities and Public Services, and Non-Specialised Trade – i.e. buying and selling varied goods – with respective turnovers of 18.7% and 16.3%.

Hungary was pushed down to 4th place, with 54 companies on the list, down 10. Aggregated turnover amounted to EUR 142.4bn in 2022, while the Coface credit assessment for Hungary is 6.3, just below the CEE average. Minerals, Chemicals, Petroleum, Plastics and Pharma is the biggest sector for generated turnover, of 24.6%, among large Hungarian companies. In second place is Electronics and IT, and in third Automotive and Transport, with 18.8% and 14.5% respectively.

Slovakia, Bulgaria lead over Baltics

Although Slovakia and Bulgaria are ranked joint 5th with 31 companies each, Slovak firms reported higher turnovers than their Bulgarian counterparts. Automotive is strongly represented amongst the largest companies in Slovakia (37% per turnover, 23% per company).

The turnover of the largest firms in Bulgaria increased by 69.9% to EUR 59bn while net profits rose by 59.8%. Utilities and Public Services was the most dominant sector, with a 32% turnover share.

Lithuania is still on 22 companies, followed by Slovenia and Serbia (14), then Croatia and Estonia (13). Latvia shores up the list with five companies. Around 12% of the total CEE Top 500 turnover comes from Baltic countries.

Smaller sectors throw up surprises

Non-Specialised Trade moved down to 4th position in the current ranking and is represented by 66 companies, down 10, the largest drop of all sectors.

Electronics, Information & Telecommunications suffered from a progressively deteriorating economic situation. The number of IT companies decreased by 5, to 61. The 6th-ranked sector of Agriculture, Meat, Agri-Food & Wines again provided 47 businesses. Poland and Romania are home to the sector’s largest companies. Next sector is Metals with 18 companies, up 3.

The best rated industry is Wood & Furniture, with an average assessment score of 8.5, represented 5 times on the list again this year. The sector recorded turnover growth of 37.5%, while net profits grew by 51.1%. These companies have a very sound financial basis, according to Coface.

Retail sector makes Poland big employer

Over half of Top 500 employees work for Polish companies, despite only one-third of the companies being from Poland, partly due to its high number of retailers in the Top 500. As well as retailer Jeronimo Martins Polska (78,000 employees) Poland also hosts postal service Poczta Polska (66,000 employees) and energy giant Orlen (64,000 employees).

Top 500 companies employ 11.3% of the workforces in both Hungary and Romania, and of 7.8% in Czechia. Non-Specialised Trade payrolls grew by 1.2% in 2022, and employed around half a million people (23.4%) in 2022, making it the largest sector for jobs.

Minerals, Chemicals, Petroleum, Plastics & Pharma has the second-largest payroll in the Top 500, or 16.7%, just ahead of Automotive & Transport on 16.1%. The 5 largest sectors employed 78% of the Top 500 staff in 2022. Of the 13 sectors, 4 had falling payroll numbers.

Lithuania hot spot for Top 500 employees

Companies have been very important employers in CEE, Coface writes, and those in the Top 500 increased payroll numbers by 3.5% in 2022.

Despite an ongoing economic slowdown, the CEE labour market remains favourable for employees, and unemployment remains below the EU average of 6.2% in every CEE country except Latvia, Croatia and Serbia.

In recent years more and more companies have been reporting labour shortages as a barrier to business operations in CEE. Sourcing skilled workers can be problematic, while nominal wages are growing in the region.

The Top 500 companies have increased their total headcount by 3.5%, to 2.3mn, meaning 4.8% of the labour force works for a firm on the list, up 0.3 of a percentage point from 2021. This confirms how key these companies are for CEE’s labour market, according to Coface.

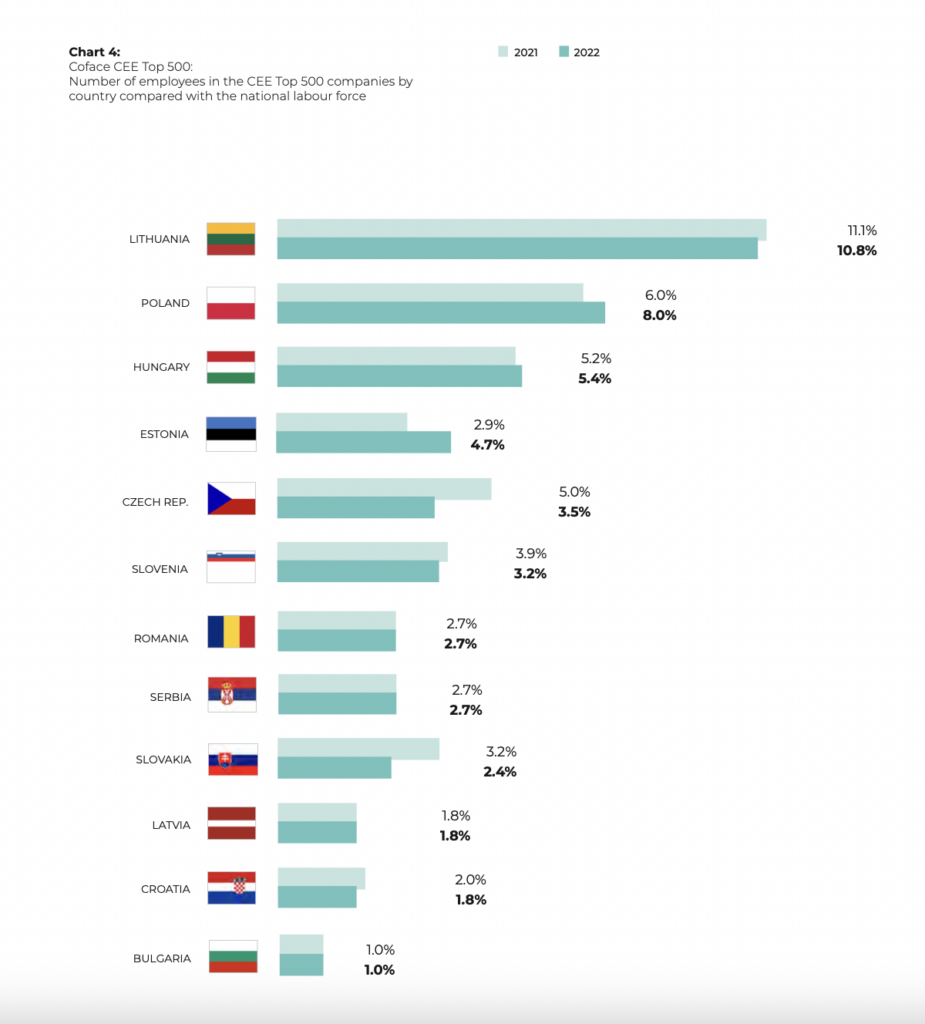

Lithuania retains the highest percentage of labour force employed by Top 500 companies (10.8%), followed by Poland (8%) and Hungary (5.4%). A decline in employment at the largest companies was reported in 6 countries, with the highest falls in Czechia and Romania (by 1.5 and 0.9 percentage points, respectively). The remaining 6 countries posted increases, notably Poland (up 2 percentage points) and Estonia (up 1.9 percentage points).

Grzegorz Sielewicz, Regional Economist Coface Central and Eastern Europe, said “the main risk in 2023 is the challenging external economic environment in Western Europe, particularly in Germany, which may affect CEE countries due to weak economic activity and subdued global trade.

“Despite this, a gradual recovery is anticipated in the coming quarters. While household consumption has been affected by inflation and higher interest rates, it is expected to gradually contribute to growth as disinflation progresses and the labour market remains strong,” Sielewicz added.