A new dawn for nuclear in CEE - CET analysis

With energy-intensive industries to sustain, Central and Eastern Europe (CEE) is turning to nuclear power to simultaneously meet energy needs and climate targets. Nuclear looks set to be around 50% of the energy mix of several CEE countries within years.

The war in Ukraine transformed Europe’s energy landscape, and the consequent loss of affordable and accessible supplies via pipelines has harmed industrial competitiveness.

Energy-reliant countries now face a tough challenge: securing stable energy supplies and sustaining economic growth while keeping costs low, diversifying sources, and meeting climate change targets. The reopening of coal mines in Germany and elsewhere is evidence of this new reality.

Amid the unfolding economic crisis in Germany, Free Democratic Party politician Christina Durr has asked Economy and Climate Protection Minister Robert Habeck for an energy strategy that simultaneously secures affordable supplies, while meeting climate goals.

While Habeck’s hands are tied due to a stated commitment to phasing out nuclear, many CEE countries are now turning to nuclear power to “cut the Gordian knot”.

A large share of energy-intensive industries in CEE economies

Energy-intensive industries (EIIs) account for more than half of industrial energy consumption in the EU. Moreover, CEE countries tend to be even more economically weighted to EIIs than the EU average.

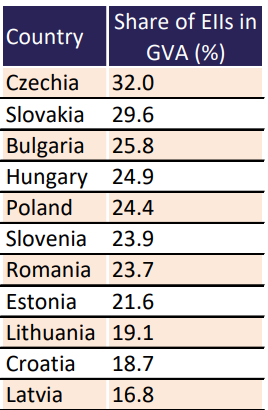

In 2019, the highest share of EIIs in Gross Value Added (GVA) was recorded in Czechia (32%), followed by Slovakia (29.6%) and Bulgaria (25.8%), compared to the EU average of 23.9%, Italy’s 19.9% share of EIIs, Germany on 17%, and France with 10%, according to data from Eurostat.

Sectors in which CEE countries have a significant presence include steel, auto, chemicals, metallurgy, cement, glass and ceramics, mining and mineral processing, electricity generation, heavy machinery and equipment, textiles and clothing, and pulp and paper.

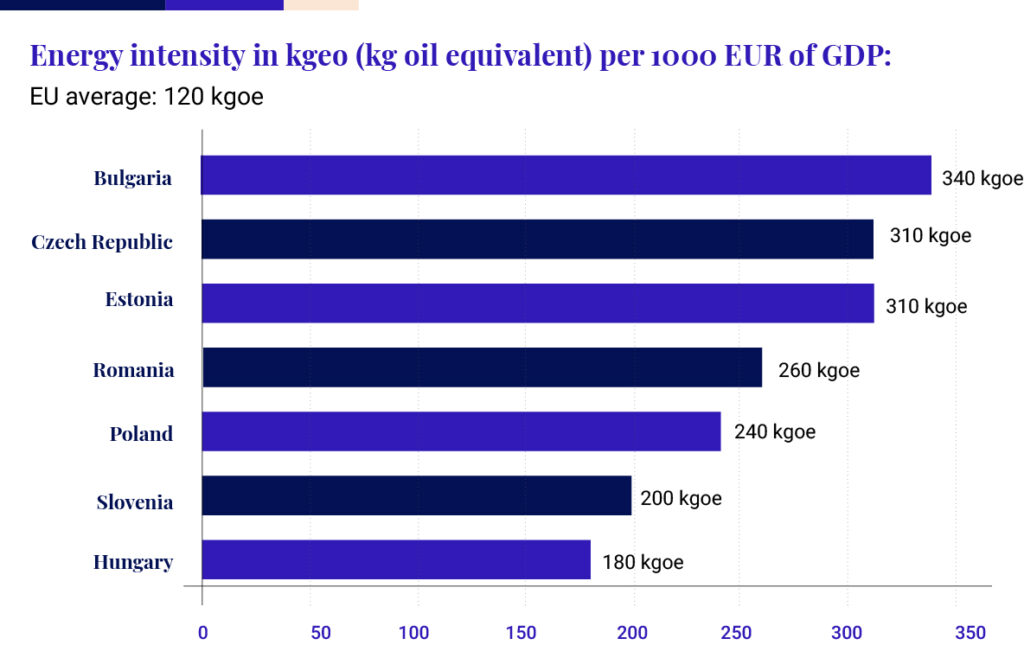

This map illustrates energy intensity in relation to GDP purchasing power standards (PPS), i.e. dependence on energy consumption for economic growth, where lower intensity indicates more efficient energy usage.

The energy intensity of the EU in 2020 was 120 kg of oil equivalent (kgoe) per EUR 1,000 of GDP, according to the EU Energy Statistics Pocketbook and country datasheets. This means that the EU consumed 120 kgoe of gross available energy for every EUR 1,000 of GDP generated.

CEE countries have a much higher energy intensity than the EU average because they have a larger proportion of EIIs in their GDP. Additionally, they have varying levels of economic development, industrial structure, climate conditions, and energy efficiency policies.

As fossil fuel prices continue to rise, many CEE countries are beginning to realise the importance of maintaining existing nuclear reactors in the transition towards clean energy. Consequently, postponing the shutdown of ageing reactors and building new ones has become more appealing from both economic and supply standpoints.

Poland plans first nuclear plant

The share of coal in Poland’s energy mix is notoriously Europe’s highest, at 70% according to 2021 data, with nuclear energy only 0.1%. Poland’s energy policy until 2030 currently charts 1.5% annual increases in primary energy consumption.

Polish energy demand could increase by 20-25% by 2040, according to “Towards Poland’s 2040 Energy Mix”. As a result, the country is speeding up preparations for its nuclear power plant programme, with the goal of building 6-9 GW of total reactor capacity.

The construction of Poland’s first nuclear power plant will begin in 2026, and the first reactor – with a capacity of 1.0-1.6 GWe – is planned to be operational by 2033. Poland’s Climate and Environment Ministry recently approved Polskie Elektrownie Jadrowe (PEJ) to use Westinghouse’s AP1000 technology to build a nuclear power plant in Pomerania.

Slovakia could become number two in EU for nuclear

Slovakia’s energy consumption is expected to reach 18 Mtoe in 2021, a 4.5% increase from pre-pandemic levels, and aims to achieve a 19% share of renewable energy by 2030 to reduce reliance on fossil fuels and Russia.

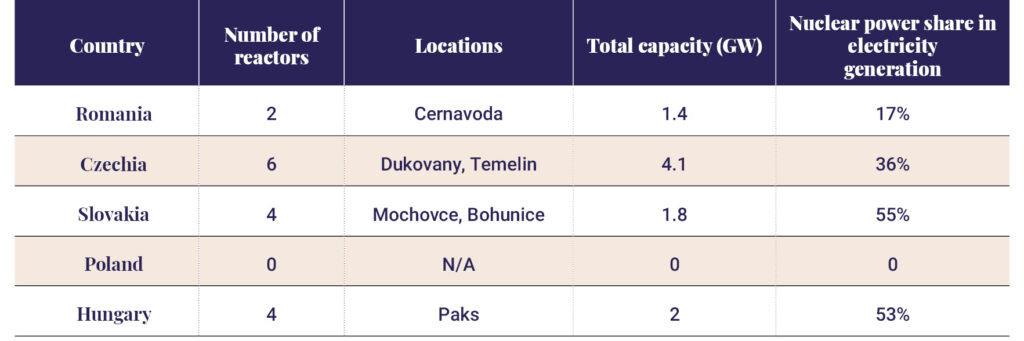

The country relies heavily on nuclear energy, which contributes to 32.8% of its total final energy consumption through 4 reactors. Recently, the country added a 5th reactor to the grid in 2023 and plans to connect another in 2024. This could potentially make Slovakia the second-largest producer of nuclear power in the EU.

Hungary leads EU for solar power

Hungary’s per capita energy consumption is 13% below the EU average. After a period of rapid growth of 4% per year from 2014-18, total energy consumption declined by 1.7% per year from 2018-20. Hungary leads the EU in solar power with 11.1% of total production, surpassing even Spain and Greece, and is also increasing gas production for grid stability and industry support.

The country generates over 50% of its domestic electricity through nuclear energy in Paks, central Hungary, making it the third highest among International Energy Agency countries after France and Slovakia. The Paks II expansion project will replace the existing units of Paks with two new units of 1.2GW each, using Russian-designed VVER-1200 reactors. Russia’s Rosatom is constructing and will operate the units, with the first one starting in 2025 and the second in 2030. Rosatom will also provide fuel and oversee the operation for 60 years.

Czechia plans two reactor revamps

Czechia’s energy consumption is 32% above the EU average, with each person consuming 5,700 kWh of electricity. The country relies heavily on coal but aims to lower its usage to 11-17% by 2040. To meet energy needs, Czechia is planning to increase nuclear energy from the current 25-33% to 46-58%, also by 2040.

The country will build nuclear reactors at two existing sites: Dukovany and Temelin, both in south Czechia. At Dukovany, one large reactor will replace four older units by 2035. The new reactor will have a capacity of about 1200 MWe and will be based on the Generation III+ technology. The government also intends to add new capacities at Temelin, where two VVER-1000 reactors are currently operating.

In addition to the large reactors, Czechia also plans to build its first small modular reactor (SMR) by 2032. The SMR will be located at the Rez nuclear research centre near Prague and will have a capacity of about 100 MWe.

The reactor will also be used for research and development purposes, district heating and hydrogen production. The SMR project is backed by the Czech president, who stressed the role of nuclear power in enhancing the country’s energy security and climate protection.

Romania EU’s second-largest gas producer

Romania’s energy consumption per capita was around 1.8 toe in 2021, 36% below the EU average, while electricity consumption is 2,620 kWh/capita, 51% below the mean. The country is meanwhile the EU’s second-largest gas producer.

By 2031, Romania plans to construct a new nuclear unit at Cernavoda, south-east Romania, to meet its energy needs and have renewable resources provide 31% of its consumption by 2030.

Currently, the Cernavoda power plant has two nuclear reactors using Canadian Candu technology with a capacity of 1.3GW. The government has decided to build two new units using the same technology instead of partnering with Chinese companies. Romania will be the first European country to adopt SMR technology by 2030, backed by the US company NuScalePower. The US has pledged to provide USD 3bn to finance the construction.

Once all the construction projects for nuclear power plants are completed, CEE will have a significant reliance on nuclear power, with some countries having around 50% of their energy mix coming from this source. However, breaking dependence on Russia will remain challenging, given that the country supplies roughly half of the world’s nuclear fuel.