Mixed prospects in region for pay-TV industry, new research finds

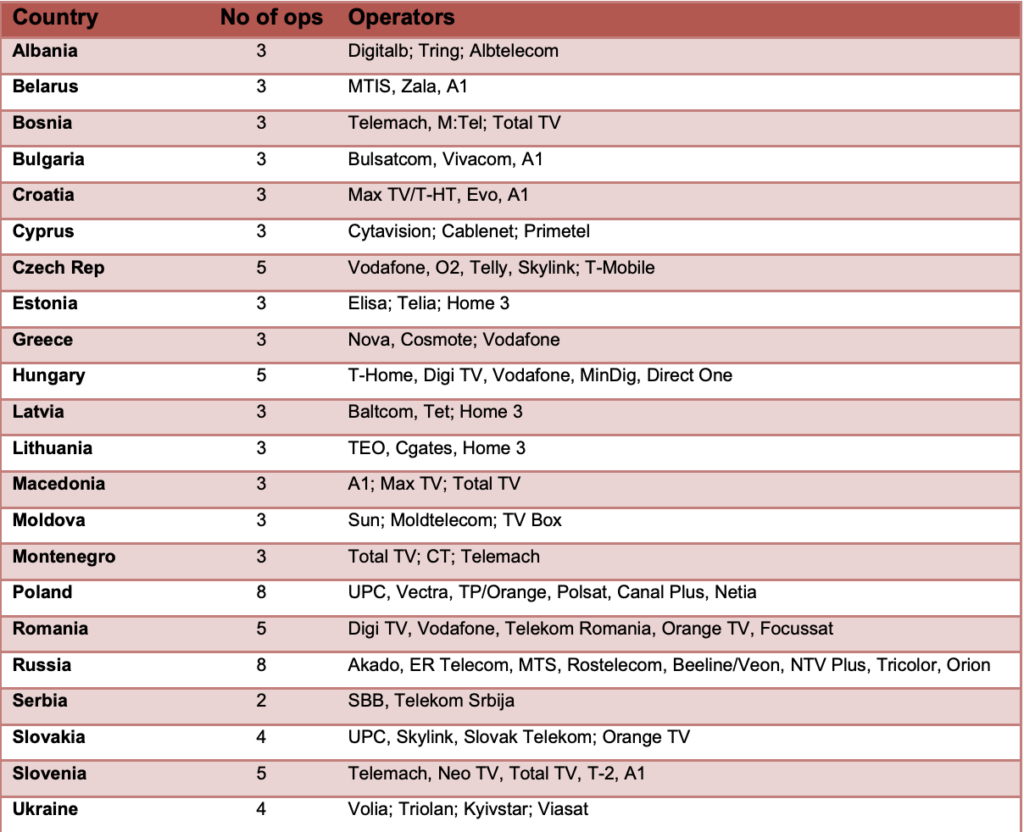

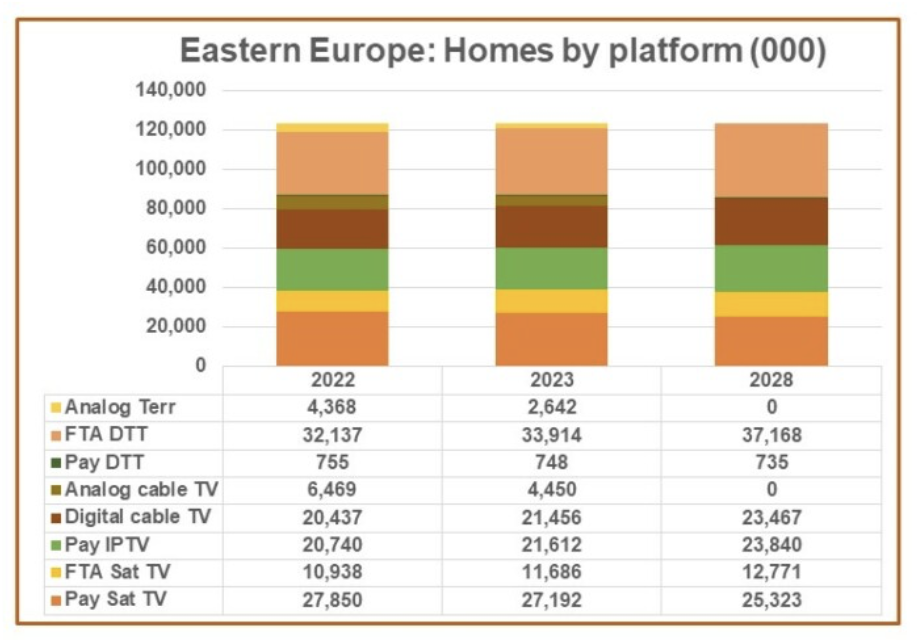

The number of pay TV subscribers in Eastern Europe will decline by 8mn from its peak of 81mn in 2018, to 73 million by 2028, according to a new report by Digital TV Research.

However, the figures for 2018 included 17mn analogue-cable subscribers, which will have dropped to zero by 2027, the digital TV researcher wrote. This means that the number of digital pay TV subscribers of the region will actually climb by 8mn between 2018-28.

“Even without the crisis in Ukraine, tough times continue in Eastern Europe,” Digital TV Research analyst Simon Murray said. “Poor job prospects (are) forcing many to seek work abroad,” Murray said, adding that “this migration married with low birth rates mean that the number of pay TV subscribers will fall in 18 of the 22 countries covered between 2022 and 2028.”

Poland becoming region’s largest OTT market

The new data was released after the digital researcher’s recent report that Over-the-Top (OTT) revenues for the 22 Eastern European countries above will nearly double to USD 5.7bn in 2028, from USD 2.9bn in 2022. OTT is a model of streaming video via an internet provider, bypassing cable TV.

According to the researcher, Poland will remain the region’s largest bringer of OTT revenue in the region, which will double from 2022-28, to USD 2.2bn. Russia’s growth will be poor due to sanctions imposed in responds to its invasion of Ukraine on 24 February 2022. Nevertheless Poland and Russia combined will account for 61% of the region’s total revenues by 2028, the researcher added.

Ad-based model growth outstrips subscription model

Murray said advertising-based video on demand (AVOD) revenues will grow faster than subscription videos on demand (SVOD), adding that “Russia’s AVOD revenues will stay just ahead of Poland.” AVOD is the online video business model supported by advertisements.

SVOD revenues will reach USD 3.5bn by 2028, up from USD 1.8bn in 2022. Due to the slowdown in Russia, Poland will become the clear market leader in SVOD by 2028, and the only country able to generate more than USD 1bn.

Russia will lose 4mn pay-TV subscribers in the 6 years leading to 2028, partly due to sanctions worsening the economic situation, and also migration from analogue cable to free-to-air digital terrestrial TV.