CEE startups secure USD 11.8bn in Q1 despite global decline

Despite an overall downturn, the Central and Eastern European (CEE) start-up scene showed resilience in the first quarter of 2024, when it secured USD 11.8bn in investor funding. AI continues to attract significant interest, representing about 17% of global funding. Other key industries receiving investments in CEE include enterprise software, fintech, healthcare, energy, SaaS, and cloud services.

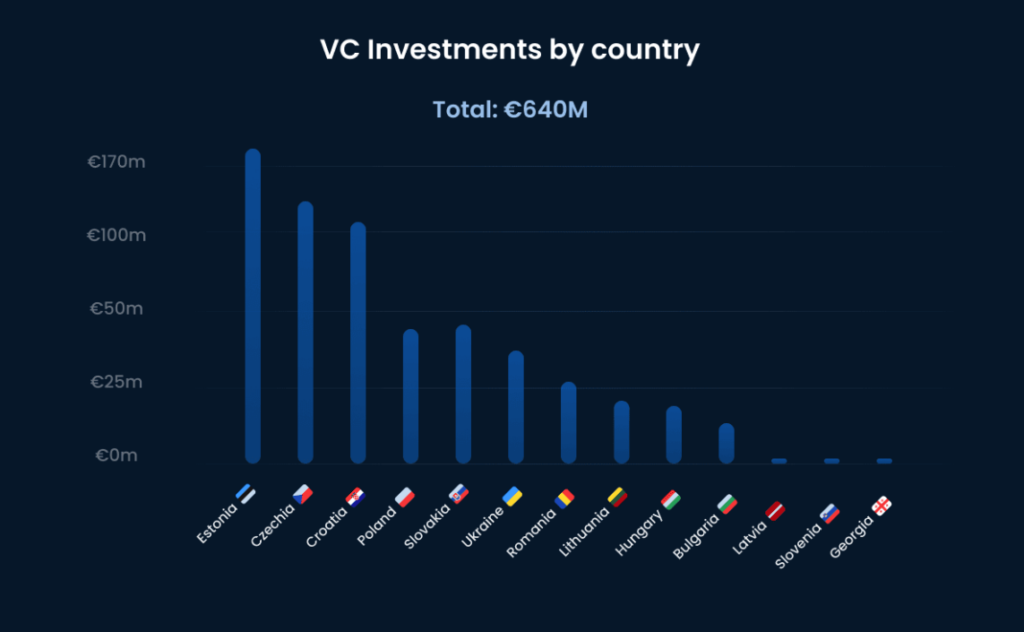

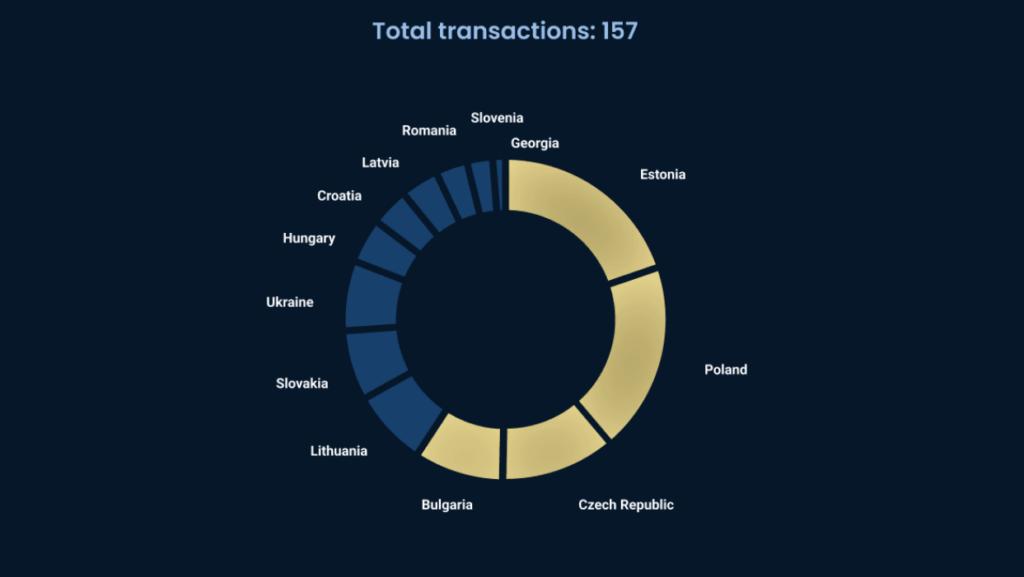

Although global startup funding dropped to USD 66bn, the second-lowest level since 2018 and down 20% year-over-year, the total investment volume in CEE slightly increased, as the number of funding rounds decreased, according to the latest venture capital (VC) funding in CEE 1Q24 report presented by Vestbee.

Estonia led the region with 31 funding rounds, followed by Poland with 30, and Czechia with 18. Some of the most significant investments included Mews with USD 101.3mn, Project 3 Mobility with USD 100mn, and Starship Technologies with USD 84.6mn.

Vestbee wrote that “there’s a palpable sense of anticipation in CEE, with funding amounts reverting to levels seen in 2019-20 and stakeholders eagerly awaiting a catalyst to reignite investor interest. While challenges persist, there’s optimism for the future, and it’s essential to remain vigilant and responsive to the evolving dynamics of the CEE region in the forthcoming quarters,” the VC platform added.

New VC funds emerge

Several new venture capital funds were established in Q1 2024. OTB Ventures launched its second deeptech fund worth USD 185mn, focusing on Series A investments with a small portion allocated for seed investments.

Lithuanian-based Practica Capital raised USD 80mn for its third fund, targeting seed-stage tech startups in Lithuania, Latvia, and Estonia. Poland’s SMOK Ventures secured USD 25mn for its second fund, which aims to support approximately 35 pre-seed and seed-stage startups across CEE, including regional founders operating abroad.

Romanian GapMinder meanwhile launched a USD 80mn fund dedicated to investing in seed and late-seed stage tech companies in Romania, Moldova, Serbia, Croatia, Slovenia, and Bulgaria, Vestbee wrote.