CEE auto industry powers exports, stalls on e-mobility

Southeast Europe’s automotive industry remains a key export engine and investment destination, but its slow transition to clean mobility raises questions over future returns, according to a new report.

While Romania, Bulgaria and Serbia continue to attract foreign capital, structural delays in electrification and infrastructure risk diminishing long-term value, according to the International Trade Centre (ITC) Trade Map, a UN-WTO database of global trade flows.

Romanian leads for auto exports

Romania led the region in 2024 with automotive exports accounting for 16.5% of total national exports. Serbia and Bulgaria posted much lower shares of 2.7% and 1.9%, respectively. Car parts and accessories dominate the product mix, reflecting a heavy reliance on outgoing internal combustion technologies.

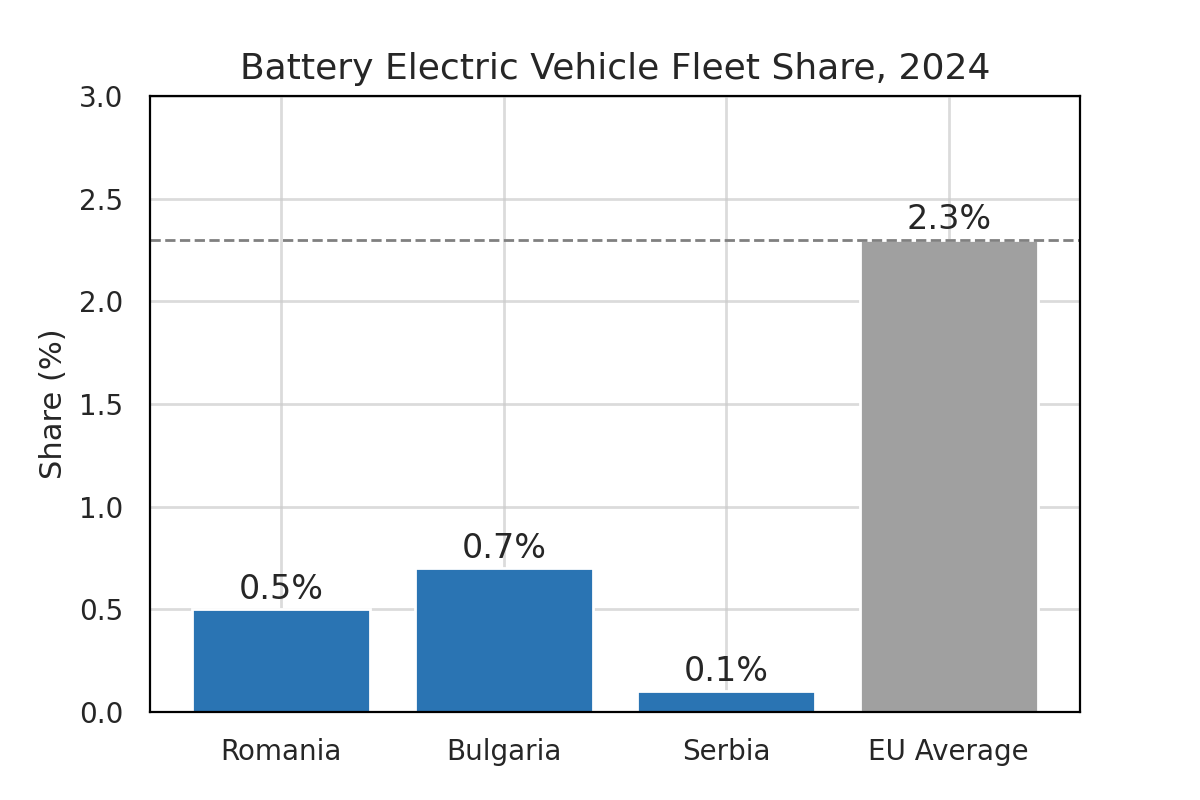

EV adoption remains marginal. Battery electric vehicles (BEVs) comprised just 0.5% of Romania’s passenger fleet in 2024, 0.7% in Bulgaria and only 0.1% in Serbia. By way of comparison, EU average penetration stood at 2.3%.

New registrations point to modest improvement, particularly in Romania, where hybrids were 41.3% of the 2024 total, surpassing petrol vehicles for the first time.

Charging infrastructure remains a bottleneck. Romania has the most stations (4,566), but Bulgaria leads in relative coverage with 15.1 chargers per 100 km of road. Serbia, with just 200 charging points, ranks lowest across all indicators. The EU average is 18.6 EV charging stations per 100 km.

Romania, Bulgaria, Serbia lag on EU policy implementation

The region’s policy frameworks remain fragmented. Romania offers the largest consumer subsidies, of up to EUR 7,500 per EV, via the Rabla programme. Serbia’s scheme offers up to EUR 5,000, while Bulgaria emphasises corporate tax breaks and EU-backed infrastructure expansion over direct incentives. None of the three has finalised the implementation of the EU’s Alternative Fuels Infrastructure Regulation (AFIR), which came into effect in April 2024.

Despite policy and infrastructure lag, investor interest remains strong. SeeNext, a regional business intelligence provider, reported in May 2025 that 62.5% of the region’s 619 tracked automotive firms are majority foreign-owned. Germany is the dominant source of capital, controlling 122 companies, mostly in Romania. French, Dutch and Italian investors also hold significant positions.

Foreign capital is concentrated in car parts and electronics; the two most profitable and export-oriented segments. In 2023, these two categories generated EUR 30.6bn operating revenue combined. However, both face rising input costs and mounting pressure to shift towards software-defined and emission-free platforms.

“The sector is robust and resilient, but transformation costs will be high,” SeeNext wrote. “Investors must weigh current profitability against the risk of stranded assets.”

Romania offers the most developed vendor base, with 231 companies in the parts segment alone and strong links to German and French original equipment manufacturers (OEMs).

Bulgaria and Serbia remain smaller but feature competitive wage levels and state support for greenfield investment. Serbia’s recent legal updates on EV charging and building codes suggest movement, but implementation remains incomplete.

Shift to emission-free platforms underway

As the 2035 zero-emission vehicle mandate looms, the region's role in the European automotive value chain is under pressure. According to SeeNext, “the shift toward software-defined and emission-free platforms is already underway”, but Southeast Europe’s transition remains partial and delayed.

While the region has “a strong base of suppliers delivering not only within Romania but especially to countries in Western Europe,” the report warns that “transformation costs will be high”. Without faster alignment with EU regulations and infrastructure standards, SEE risks “falling further behind in the automotive transition it once helped build.”

For investors, SeeNext notes that profitability in car parts and electronics remains strong, but cautions that “companies must now compete not just on cost but on readiness for an electric, software-driven future.”