CEE diversifies on gas, as Merz decries Nord Stream 2 'mistake'

Central and Eastern Europe (CEE) is speeding its shift away from Russian gas, as German Chancellor Friedrich Merz calls Nord Stream 2 “a mistake” and vows to block its restart.

Merz rued the controversial pipeline - which has never been brought online due to Russia’s 2022 invasion of Ukraine - when he met US President Donald Trump in Washington DC on 5 June, aligning with the broad CEE consensus.

Last month, when he officially became chancellor, Merz said Nord Stream 2 must stay closed to “weaken Moscow's war machine” and said his government would “do everything” to ensure this. His remarks in the White House last week underlined this stance.

Poland, Czechia, Baltic countries long opposed pipeline

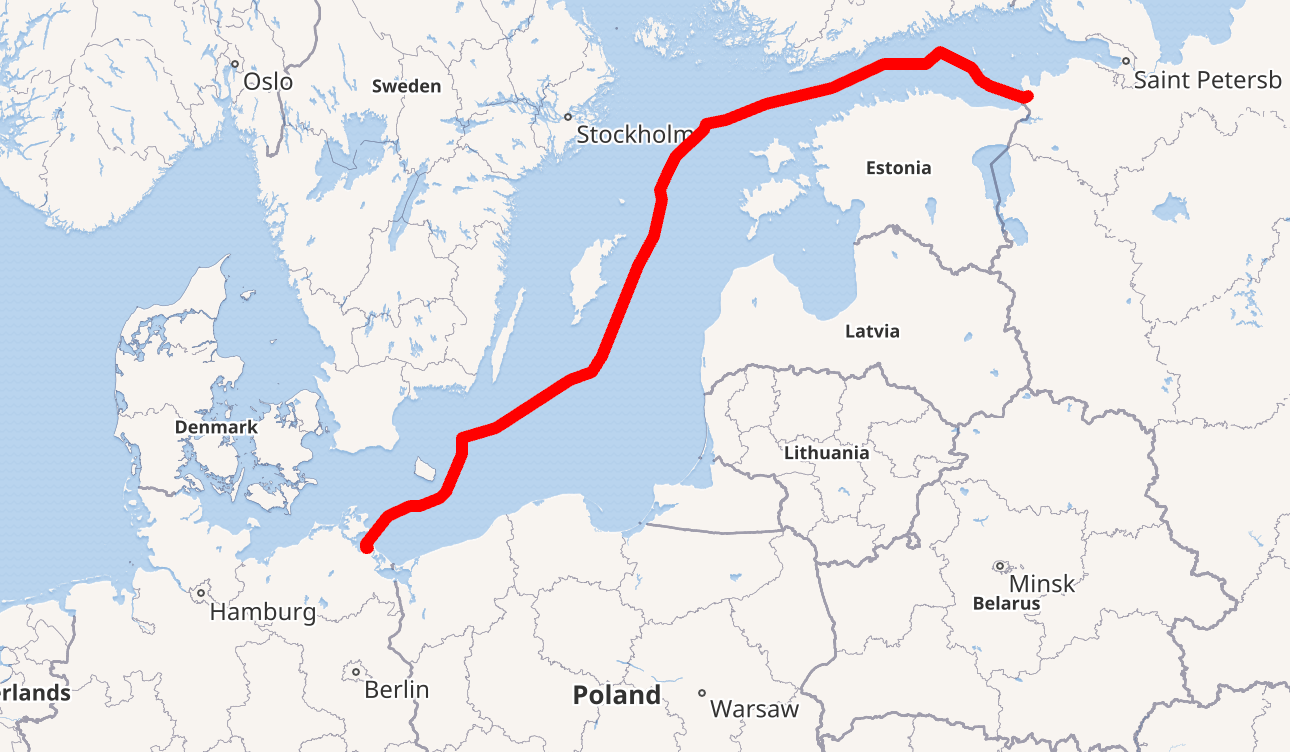

Nord Stream 2 is a Russian-German gas pipeline completed in 2021 but never brought online after Russia’s 2022 invasion of Ukraine.

CEE leaders repeatedly warned that Nord Stream 2, designed to double the capacity of the original Baltic Sea route, would increase Europe’s energy dependence on Russia and bypass transit states such as Ukraine.

Polish and Baltic officials described the project as a geopolitical weapon that undermined EU solidarity and Ukraine’s sovereignty. Lithuania, Czechia and Estonia have also lobbied the EU and the US to block the project.

Despite this opposition, the pipeline was backed by Germany and Austria, and financed by companies such as Austria's OMV and France’s Engie. Construction was completed in September 2021 but certification was suspended indefinitely in early 2022.

Up to half of Russia’s gas exports to Europe once transited through Ukraine, but the war-torn country has since lost much of this revenue and leverage, as Ukrainian President Volodymyr Zelenskyy called the pipeline “a dangerous concession to the Kremlin”.

Baltics, Poland lead in supply shift

Merz's statement came as CEE countries are implementing far-reaching energy policy changes. Lithuania was the first EU member to halt Russian gas imports after the invasion, shifting to full reliance on the Klaipeda LNG terminal from April 2022.

At the B9–Nordic summit in Vilnius on 2 June, Lithuanian Prime Minister Gintautas Paluckas rejected the revival of “strategic vulnerabilities” such as Nord Stream 2 and described energy independence as “a long-term security imperative for Europe”.

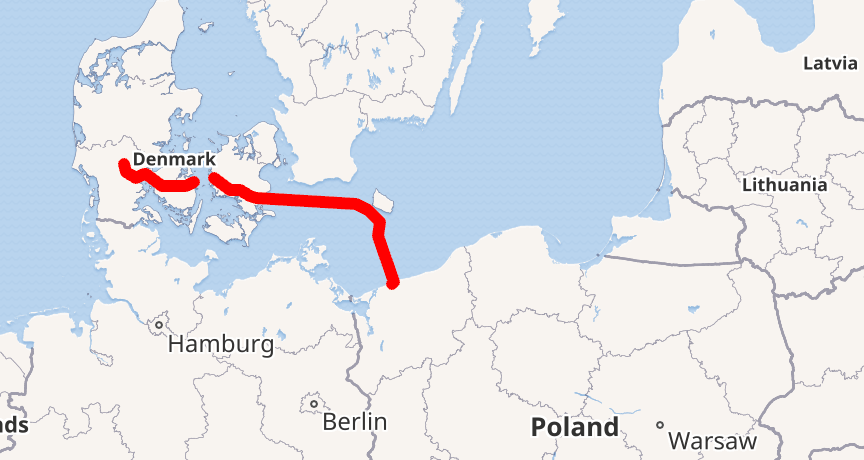

Poland introduced mandatory gas storage laws, expanded the LNG terminal at Swinoujscie, north-west Poland, and completed the Baltic Pipe to Norway. New rules require grid operators to diversify supply sources.

Also at Vilnius, Polish Prime Minister Donald Tusk and Romanian President Nicusor Dan backed language describing Ukraine’s NATO accession as “irreversible” and advocating “intensified pressure on Russia,” including new sanctions.

Without explicitly naming Nord Stream 2, their joint statement expressed support for the “permanent diversification” of energy supply to reinforce Eastern flank resistance to Russia using gas as a leverage tool.

Meanwhile, Estonia, Latvia and Finland have invested in new LNG infrastructure and revived cross-border interconnectors. In May 2023, Estonia updated its National Energy and Climate Plan to phase out all Russian gas use by 2024 and Latvia legislated its delinking from Russian gas. By early 2025, all three Baltic states had delinked from the Russian power grid.

Czechia, Slovakia, Bulgaria, Romania build alternatives

Czechia and Slovakia passed emergency legislation in 2022 enabling gas switching and LNG imports via Germany and Poland. Bulgaria and Romania accelerated the Bulgaria-Greece Interconnector, which became operational in late 2022. Bulgaria has since mandated annual tenders for non-Russian gas supply as part of a new diversification strategy.

For its part, Croatia increased the capacity of the LNG terminal on the island of Krk, north-west Croatia, and revised gas laws to prioritise domestic storage and non-Russian imports. To the north, Slovenia reformed its regulatory framework to allow short-term purchases and more flexible cross-border flows.

Further south, Albania, Montenegro and North Macedonia joined the US-backed Vertical Gas Corridor project, which aims to connect Caspian and global LNG sources to the region through Greek and Bulgarian terminals.

Hungary, Serbia maintain Gazprom contracts

Hungary and Serbia, have taken a different approach by maintaining closer relations with the Kremlin, securing new long-term contracts with Russian state energy firm Gazprom. The Serbian Energy Ministry has said it is building new gas storage facilities to safeguard supply, while Hungary continues to import Russian gas through Serbia via the TurkStream pipeline.

Bosnia and Herzegovina (BiH) also remains entirely reliant on Russian gas delivered via Serbia and has yet to pass any significant legislation to diversify its energy supply. Authorities in Republika Srpska - one of the two entities of BiH, alongside the Federation of BiH - have signalled a desire to continue its cooperation with Gazprom.

Gazprom shelves Turkey hub plan

Meanwhile Gazprom has quietly abandoned plans to develop a gas distribution hub in Turkey, a project long promoted by Russian President Vladimir Putin as a way to re-enter the European market via the Black Sea. Despite Putin’s high-profile endorsement in October 2022, that the scheme faced “considerable obstacles” and has effectively been halted, Bloomberg reported.

Analysts say the project has stalled because Turkey lacks spare capacity in its export pipelines to Greece and Bulgaria, and Ankara was reluctant to grant Gazprom control over a prospective hub.

For CEE, the collapse of the Turkish hub signals another missed pathway for Russia to regain leverage after the Ukraine-triggered collapse of Nord Stream 2. With Turkey’s pipelines effectively siloed, and Bulgaria and Greece increasingly integrated into EU energy networks, Gazprom’s options have narrowed, reinforcing the strategic value of EU-backed infrastructure and diversification in CEE.

EU policy shifts as Russian flows fall

The European Commission (EC) has noted that pipeline gas imports from Russia fell by more than 70% from 2021 to 2023. Under the REPowerEU strategy, the EC has called for accelerated LNG investment, more energy links and a coordinated storage framework across the EU.

Merz’s remarks underscore what leaders from Vilnius to Warsaw have long argued: Europe’s energy security cannot be built on Russian pipelines.