Hungary inflation to dip, GDP to rise this year - independent think tank

From Hungary’s economic perspective, last year extended the trends observed in 2022, according to independent Hungarian think-tank Policy Solutions’s annual report.

In Central and Eastern Europe, and Hungary in particular, inflation emerged as a paramount economic concern. In Hungary, inflation was of a scale unseen since the 1990s.

The Hungarian macroeconomic outlook persisted in challenging trends with high inflation levels and dependency on Russian gas and crude oil imports which sank domestic production into recessions. Faced with post-Russia energy dependency and cost of living rises, Hungary saw lower private consumption, higher interest rates and less private investment.

Foreign investment key for GDP, not so lucrative for tax office

Much of Hungary’s GDP growth came through multinational companies, on exports, and in the agricultural sector. Policy Solutions notes that “corporate income tax was reduced to 9%, the lowest rate anywhere in Europe”, adding that “effective corporate tax paid on their income by Hungary’s 30 largest – primarily foreign – companies was even less, a mere 3.6% in 2017. In 2022, the effective tax rate was around 5.7%.

“The primary beneficiaries of the ultralow tax environment during the 2010s were the German carmakers, while more recently, increasingly East Asian power battery producers. Given that favourable tax rates for large corporations represent one of the essential pillars of the Orbán government’s economic policy, it came as little surprise that it was not in favour of the US-proposed 15% minimum corporate income tax rate. Hungary was the only OECD (and EU) country to veto the globally applicable tax in June 2022,” the think-tank adds.

“China’s CATL, the world’s largest battery producer, is expected to create 9,000 jobs in Debrecen; Sunwoda in July announced a new battery factory will be built in Nyiregyhaza, creating a thousand jobs; and a third Chinese battery firm, Eve Power, signalled another 1,000 jobs at its new factory in Debrecen.

“So far, around 40 battery production-related projects have been brought to Hungary in the value of HUF 8tn (around EUR 21.1bn). The government aims to turn Hungary into a global battery production centre. According to its latest plans, by 2030, the country should produce batteries with a capacity of 250 GWh,” according to the think-tank.

Private consumption down in 2023

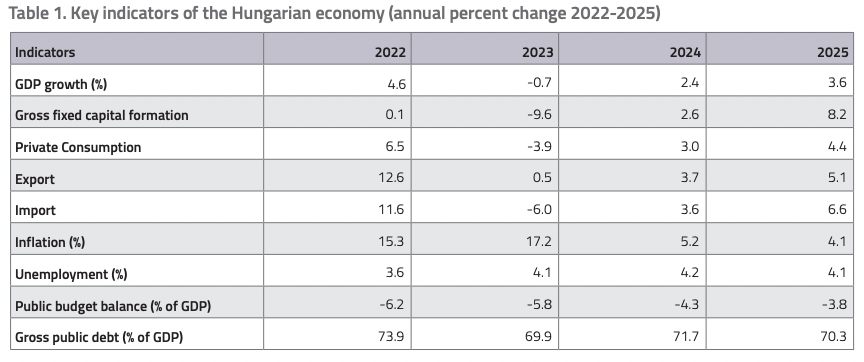

Hungary faced a recession in 2023 following the European Commission’s downward revision of Hungary’s GDP growth forecast to -0.7%, after four successive quarters of negative growth.

However, with reports of a third-quarter GDP growth in Hungary of just 0.4%, economists remain apprehensive about this given the recent personnel shift for calculating economic indicators determining performance. “The individual responsible for calculating Hungary’s economic performance indicators for the past 27 years; he was replaced by an economist with strong ties to the government shortly before the publication of the last quarter’s data,” Policy Solutions explains.

Consumer confidence gained a marginal uptick from its record low, but the overall sentiment was negative, and business sentiment also remained negative. Government responses to the economic crisis were characterised by pro-cyclical policies and blaming EU sanctions, although Hungary actively supported these.

Policy Solutions writes: “The figures in the European Commission’s forecast illustrate the intricate relationships between these economic indicators. In the Commission’s projection from the previous year, an expectation was set that the Hungarian economy would encounter challenges in 2023, with a mere 0.1% GDP growth forecast for the country. However, by the close of 2023, the Commission found it necessary to revise this projection downward, characterizing the economic situation as a recession and predicting a contraction of 0.7%.”

Inflation hit 21st-century highs

The think-tank writes: “The cumulative inflation between January 2021 and October 2023 amounted to 41.6%. The surge in inflation can be attributed to a myriad of external and internal factors. Externally, the escalation of energy prices, corporations raising prices above inflation, and disruptions in global supply chains have played pivotal roles.

“Internally, contributing factors include a deteriorating exchange rate, pro-cyclical policies involving one-time handouts (such as income tax cuts and pension bonuses) aimed at appeasing the electorate ahead of the 2022 general elections, and, most significantly, Hungary’s heavy reliance on Russia’s energy supply,” Policy Solutions adds.

Inflation peaked at an annual rate of 25.7% in January, with food and energy prices soaring out of control. Government policies such as mandatory promotional pricing and reshaping the residential energy subsidy programme have helped in the reduction of inflation but may trigger some long-term consequences.

Hungary’s central bank MNB set the highest interest rates choice in Europe to fight inflation therefore impacting mortgage costs and manufacturing growth. The Hungarian forint settled in 2023 but remained weaker than other regional currencies, adding to inflation, although the easing of natural gas prices reduced some pressure on imports.

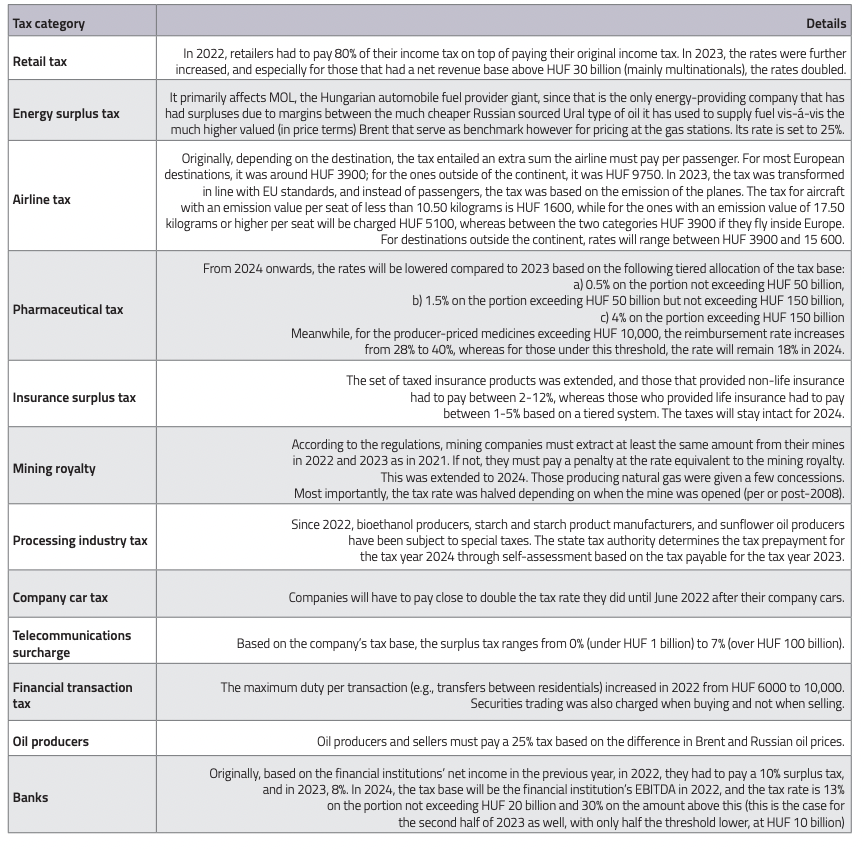

EU funding and corporate tax concessions made sizeable contributions to the economy, but two significant developments were delays in accessing EU funds due to disputes over the rule of law and the imposition of “surplus” taxes.

Social issues in Hungary in 2023 included high unemployment, poverty rises, and a lack of social support. The government, however, prioritised investment in sports and large corporations over social welfare. Education and health care were plagued by low budgets and salaries, leading to protests and a threat of declining education levels.

More cause for optimism in 2024

For 2024, the picture is slightly brighter with an anticipated growth rate in GDP and lower inflation. However, difficulties persist in the form of public debt, balancing economic policy and dependence on EU funds. Focusing on manufacturing along with the absence of favourable conditions for domestic innovation and knowledge intensity could slow down long-term economic development.

Primarily, efforts to find alternative sources for energy supply reduced the share of Russia in the EU market. The restructuring of the residential energy subsidy programme diminished inflation but may result in consequences that last for a longer time, according to the Hungarian think-tank.