'No new taxes' as Romania cracks down on evasion

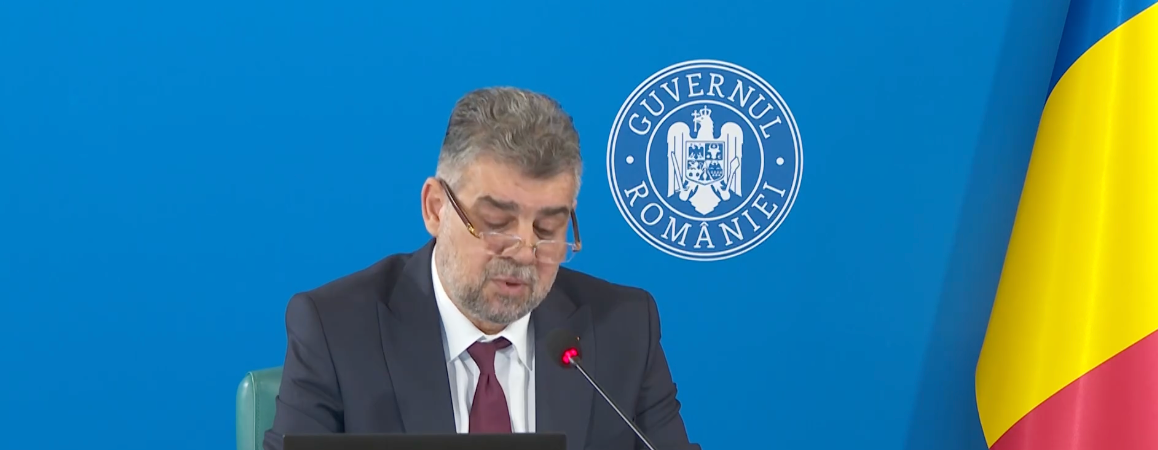

Romania will not levy new taxes next year, Romanian Prime Minister Marcel Ciolacu pledged on Thursday 16 November, with parliamentary elections expected in around a year.

“I said very clearly that there will be no new taxes next year,” Ciolacu said at the opening of a government meeting. “I want only one thing, instead, I want those who didn’t pay their taxes until now – those who defrauded the state and who steal from Romanians’ health, education and pensions – to pay their taxes.” The government also wants to tax undeclared income by 70%.

Ciolacu in September declared that Romania has the largest tax evasion rates in the EU. “I want to inform you, with sadness, that we have the largest tax evasion in the EU, over 10% of GDP, that is RON 160bn (EUR 32.19bn),” Ciolacu said.

Asset tax intake up

Under a new measure, asset tax collection office ANAF is targeting people who publicly display undeclared valuables, putting pressure on the body, which has been criticised for its lack of action, local media wrote.

“The good news we start with is that the ANAF has started to do its job and collect close to the imposed target. In October, revenue collection reached a record level of RON 40bn (EUR 8bn).

“Finally, state institutions are beginning to show determination against those who defraud Romanians’ of money, and eliminating the evaders who steal tens of billions every year is the key to get the necessary funds for pension hikes, for education, and for health,” Ciolacu added.

Digital key to solving tax collection amid new economic realities

Romania’s temporary coalition government has discussed budgets and taxes with numerous international bodies. After hosting with International Monetary Fund (IMF) experts last month, Romanian Finance Minister Marcel Bolos said the IMF had advised the government to crack down on tax evasion. As well as taxes and fees, the Fund highlighted the importance of the budget deficit, economic growth and predictable fiscal policy.

Former Romanian Finance Minister Anca Dragu said “the Treasury requires reform to keep up with economic realities and the diversification of income sources, as experts claim. “The level of collection is only 26% of GDP, a percentage that places Romania far behind other European countries,” Dragu added.

Romanian Investments and European Projects Minister Adrian Caciu said digitisation is a key tool for combating tax evasion. “Intensive work is being done on this project and is welcome,” he added.

Ciolacu said the ANAF’s increased performance rates means Romania will be able to keep its budgetary agreement with the European Commission (EC). “I am convinced that by keeping the same pace until the end of the year and keeping non-essential expenses under control, we will respect the deficit target agreed with the EC.”