Romania leads CEE for EV adoption

Reading Time: 3 minutesElectric vehicle (EV) adoption across Central and Eastern Europe (CEE) remains uneven, with significant variations between countries in the region, according to new data from the European Environment Agency (EEA).

Adoption rates in CEE lag behind Western Europe: the Western Balkans, for example, has just 1,540 public EV charging stations, compared to 75,000 in the Netherlands alone. Meanwhile, Poland had met only 9% of EU-mandated fast-charging targets by late 2023. However, progress is being made thanks to government incentives, EU funding, and growing public awareness of the benefits of sustainable mobility, the EEA wrote.

Slovenia, Hungary, Romania lead

Romania is the regional leader in EV adoption, with 41% of vehicles registered being battery electric vehicles (BEVs) or plug-in hybrids (PHEVs), in part thanks to the country’s subsidies for EV purchases, tax incentives and efforts to electrify corporate fleets.

Association of Romanian SMEs (small and medium-sized enterprises) president Ioana Dragulescu commented, “Romania’s subsidies for electric vans are helping small businesses transition to green logistics”.

In Hungary EVs accounted for 11% of total vehicle registrations, aided by a focus on developing charging infrastructure and promoting green transport initiatives. Director of Public Transport Development, Hungary Gabor Karacsony said the Hungarian capital Budapest “is at the forefront of testing hydrogen fuel cell buses as part of its Green Bus Programme”.

Slovenia had a 10% EV adoption rate, supported by EU-backed projects to enhance cross-border mobility and sustainability, thanks to the country’s partnership with Renault on the Twingo E-Tech. Lithuania (12%) and Greece (11.3%) also show promising growth, leveraging regulatory support and increasing consumer interest in EVs.

Stragglers: Poland, Slovakia, Croatia

CEE’s largest automotive market, Poland, recorded a 4.1% EV share, due to its limited charging infrastructure, fewer subsidies, and the prevalence of second-hand cars. Eleport Poland CEO Aneta Korzeniowska said “Without adequate charging infrastructure, consumers are reluctant to purchase EVs, creating a ‘chicken-and-egg’ dilemma.”

Slovakia and Croatia also reported low adoption rates of 5.3% and 4.8%, respectively, underscoring their need for greater investment in infrastructure and consumer education. “Croatia’s charging network now covers every national park, making sustainable tourism accessible to EV owners,” Croatian National Parks Association official Marko Radic told CEE Energy. Moreover, Croatia is establishing the region’s largest (1,200 kW) charging hub for lorries and buses.

Barriers to EV growth in CEE

According to the recent Electromobility E-Book, 2024, published by CEE Energy News, several obstacles impede progress in CEE, including limited charging station availability, higher upfront costs for EVs, and inconsistent government subsidies.

The EU’s Critical Raw Materials Act (CRMA) provides a framework for resource security, but effective local execution will determine its success. CEE holds 25% of Europe’s lithium reserves, essential for EV batteries, the Electromobility report said. However, Ukraine’s lithium deposits, sufficient to support 20mn EV batteries, remain underutilised due to the war.

The report highlights Lithuania as a success story, achieving a fivefold increase in charging stations since 2019. It also sees country capitals as leading the charge to net zero, as Czechia’s Prague is planning 4,500 public chargers by 2030 and Hungary’s Budapest is advancing digital solutions through its “Budapest GO” platform.

Collaboration between public and private sectors will be key to bridging infrastructure gaps and aligning CEE with Europe’s climate goals, the Electromobility report underlines. Allego, backed by a EUR 20mn loan from the European Bank for Reconstruction and Development (EBRD), is installing 200 charging points in Poland, while Enefit plans 2,500 chargers by 2028.

Automotive manufacturing is shifting gears, as Slovakia and Slovenia secured investments for EV production from Hyundai and Renault. Maciej Mazur of the Polish New Mobility Association said: “Poland’s energy transition is driving advancements in renewable energy and zero-emission transport, reshaping the region’s automotive future”.

CEE in European context

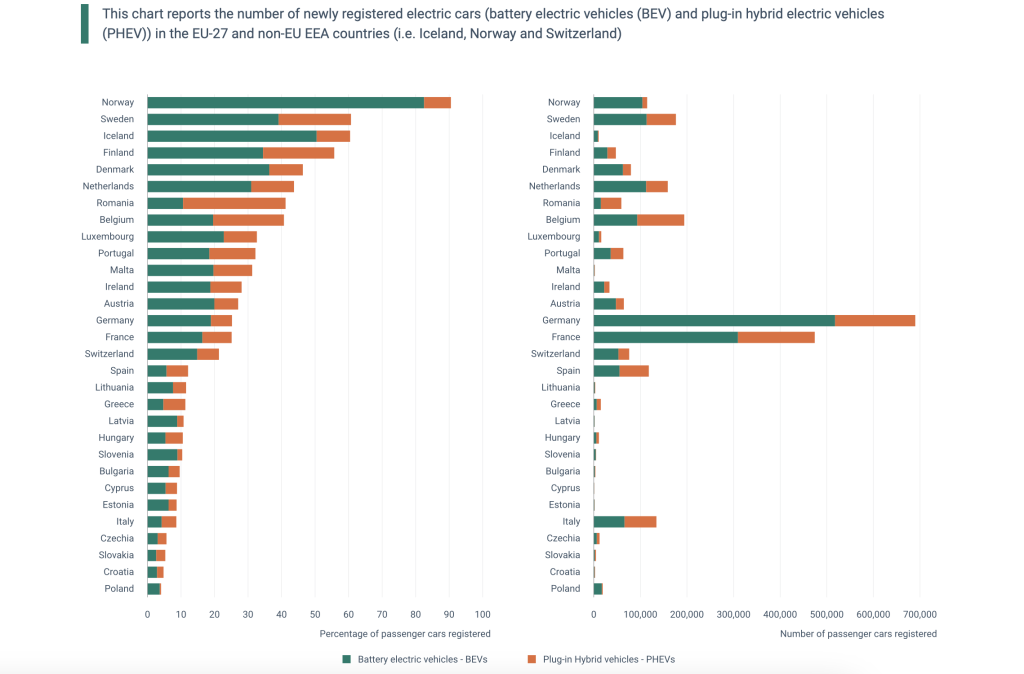

CEE countries trail Western and Northern Europe. Norway leads Europe with 91% of vehicles registered as EVs in 2021, followed by Sweden (61%), Iceland (60%), and Finland (56%). These countries benefit from comprehensive government incentives, widespread charging networks, and taxation policies that make EV ownership attractive.

Germany and France, Europe’s largest automotive markets, reported 25% EV adoption rates, reflecting significant investment in charging infrastructure and consumer demand for sustainable options.