PKN Orlen CEE’s top firm on Coface 500 list

Reading Time: 3 minutesPoland is the dominant country in the Central and Eastern Europe (CEE) business landscape, with 184 companies listed among the region’s top 500, according to Coface’s 2024 CEE Top 500 ranking.

Sector shifts, new entrants make top 500

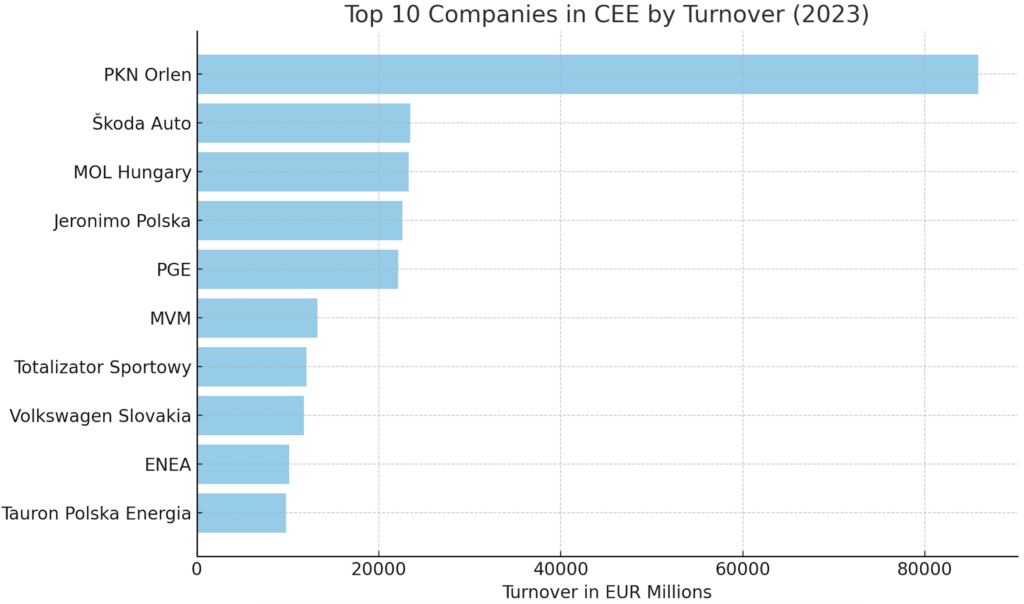

Polish energy giant PKN Orlen topped Coface’s Top 500 list and is now Europe’s 44th largest company, according to a separate ranking by Fortune magazine. Poland had the most new entries to the Top 500, reflecting a diversified economy that accounted for 36.8% of the list. Czech and Hungarian firms made up 13.8% and 12.8%, respectively.

New to the Top 10 were Polish state-owned energy companies ENEA and Tauron Polska Energia, which advanced due to electricity trading during the energy crisis. These firms benefited from robust domestic demand and, in some cases, government-backed energy strategies.

Despite a slowdown in GDP growth and significant inflationary pressure, turnover across the region’s 500 largest firms grew by 2.5%, reaching EUR 1.1tn.

Poland leads, Czechia, Hungary struggle with slower growth

Poland’s lead reflects its diversified economy and large consumer base, which continue to support its companies’ resilience despite a challenging economic climate, the trade credit risk management company wrote.

Czechia and Hungary followed, with 69 and 64 companies respectively, underscoring their manufacturing and energy sectors. Hungary, which reclaimed its third spot from Romania, saw a modest 1.6% increase in turnover, while its profitability surged by 20.3%, thanks to improved performance in key sectors including electronics and automotive.

In fourth place was Romania, with 54 companies in the top 500, down 6. Revenues at its largest firms fell by 6.9% and net profits by 21.5%. Meanwhile, smaller economies such as Slovakia and Bulgaria showed significant representation, showing the presence of large-scale industries despite smaller economies.

Auto drives on, energy faces challenges

After 3 years, the automotive and transport sector reclaimed the top spot, with a 16.8% increase in turnover and a 40.8% rise in net profits, buoyed by improved car sales, representing 18% of the ranked companies.

The sector saw a 16.8% increase in revenue, benefiting from recovering EU vehicle sales, and achieved a 40.8% boost in profits, as Czechia’s Skoda Auto and Hungary’s Audi Hungaria, with Poland’s Volkswagen Group Polska made gains.

The minerals, chemicals, petroleum, plastics and pharma sector, traditionally the largest, dropped to second place, with modest turnover growth but a 42.8% drop in net profits, amid fluctuating oil prices and falling natural gas prices.

Energy faced mixed fortunes: utilities rose in prominence but escalating input costs and market volatility put strained profitability. While utilities such as Poland’s PGE and Hungary’s MVM performed well, oil and gas companies saw net profits dropping sharply, second only to the metals sector, due to price volatility and increasing regulatory pressures.

Non-specialised trade grew as a sector as consumer demand rebounded in 2023, with turnover up 9.7%, aided by low unemployment and wage growth. High inflation impacted profitability, however, and net profits fell by 4.4% in non-specialized trade.

Employment rates up

In the face of economic constraints, CEE’s top 500 slightly upped employment levels, growing payroll by 1%, to 2.5mn people, with retailer Jeronimo Martins Polska and energy giant Orlen employing swathes of the regional workforce. However, rising labour costs and skilled labour shortages, led many to explore automation and efficiency drives.

CEO Coface CEE Jaroslaw Jaworski said “the CEE region faced unprecedented economic challenges in 2023 with a combination of high inflation and weakened consumer demand affecting even the largest companies,” adding that “despite these obstacles, many companies managed to sustain their turnover, showcasing resilience in a difficult environment”.