Lowest OECD tax burdens in Slovakia, Poland

Reading Time: 3 minutesWorkers in Central and Eastern Europe (CEE) enjoy some of the lowest personal income tax rates in Europe, with Slovakia and Poland the outliers for individuals and families, according to a new Organisation for Economic Co-operation and Development (OECD) report.

The OECD Taxing Wages 2025 report analysed tax data and social security contributions in 2024 across 38 OECD member countries. For single-income couples with two children, Slovakia recorded a negative income tax rate of 12.8%, the lowest in the OECD countries. This means such households receive more in benefits than they pay in taxes. “Generous child-related benefits offset employee taxes, creating a net gain for families in Slovakia,” the OECD wrote.

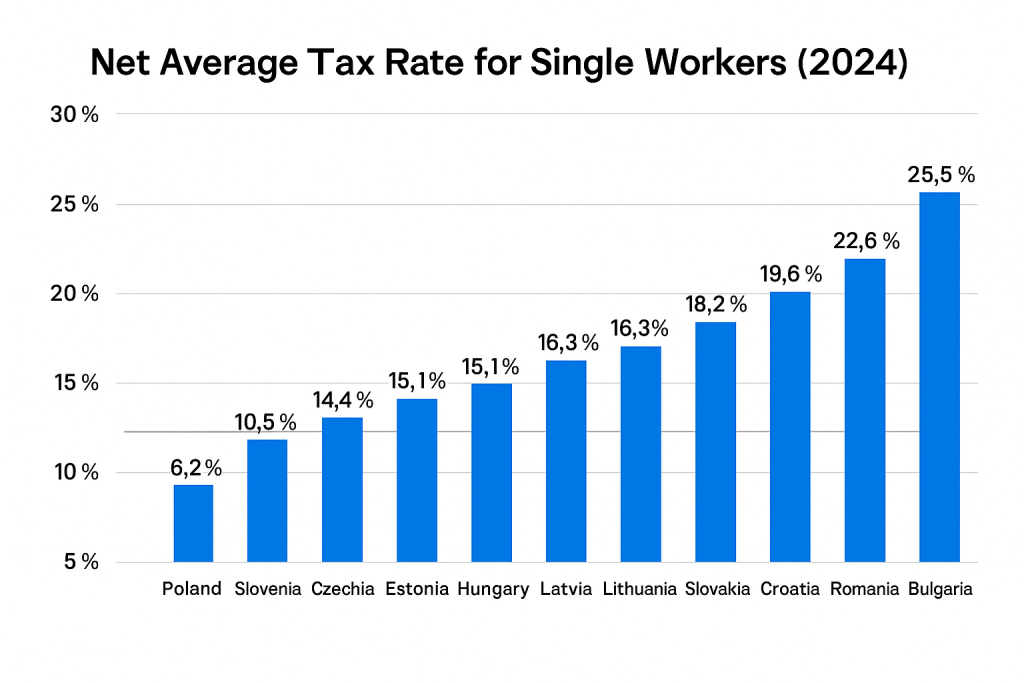

For single workers, Poland reported the lowest effective personal income tax rate for individuals without children, at 6.2%. Slovenia followed with 10.5%, then Czechia at 12.1% and Slovakia at 18.2%. All four countries were well below the OECD average of 25.5% for this category. The report noted that Poland’s figure reflected limited progressivity and a universal cash transfer system.

The OECD also tracked tax wedges, which comprise employer and employee social contributions and income tax. Hungary’s average tax wedge for single workers was 39.8%, Poland’s 34.1% and Czechia’s 39.6%, all well below Austria’s 47%. Slovakia’s tax wedge stood at 42.6%, just under Germany’s 45.1%.

The tax wedge is a key factor for employers deciding where to base staff, as a higher percentage means a larger share of labour costs goes to the state rather than into workers’ pockets. “Lower tax wedges can improve employment incentives and support competitiveness,” the OECD noted in its overview.

CEE taxation systems mainly flat or slightly progressive

The report highlights a growing divide in how European countries balance taxation with redistribution. CEE countries typically apply flat or lightly progressive tax systems. Western and Nordic countries rely more heavily on steep income tax bands and higher social contributions to fund extensive welfare states. In Sweden, the tax rate for a single worker earning 167% of the average wage rises to 28.7%, up from 16.1% on the average wage. In Poland, the difference is marginal due to flatter tax structures.

Some economists warn that CEE countries may face challenges in funding public services with such low personal income tax revenue. Governments in the region often rely more heavily on VAT and payroll taxes, which can be more regressive.

Nonetheless, the low effective tax burden remains a strategic advantage for CEE economies seeking to attract talent, retain youth and support real income growth. “There is a trade-off between low direct tax rates and long-term capacity to invest in infrastructure and education,” said Tomasz Bak, an economist at the Warsaw Institute for Economic Policy.

Baltic countries among lowest for tax

Estonia, Latvia, and Lithuania also featured among the lowest tax burdens in the OECD, reinforcing the east-west divide in European tax structures. Estonia reported a net average tax rate of 14.4% for single workers without children, while Latvia and Lithuania recorded rates of 15.8% and 16.3% respectively, well below the 25.5% OECD average.

The Baltic states’ commitment to flat tax systems and relatively lean welfare models contributes to these low rates. However, the OECD said such systems offer limited income redistribution and may face sustainability challenges as healthcare and pension costs rise.

On Estonia, the OECD said “the tax wedge for the average single worker increased by 0.7 percentage points from 39.9% in 2023 to 40.6% in 2024”, due to it eliminating certain allowances. Similarly, the OECD highlighted that in Latvia, “the increase (in the tax wedge) was mostly due to the fact that the tax schedule did not change between 2023 and 2024,” leading to higher average tax rates as wages grew.

These developments suggest that while the Baltic countries maintain competitive tax systems, they must consider adjustments to address evolving economic and demographic pressures.

Tax policy design should ensure fairness, resilience, OECD concludes

The OECD called on policymakers to consider the full tax-benefit balance rather than focusing solely on personal income tax rates. As European countries navigate ageing populations and long-term fiscal pressures, tax competitiveness may increasingly shape labour mobility and regional investment flows. “Tax policy design should not only support economic growth but ensure fairness and resilience,” the OECD concluded.