CEE startups outpace Western Europe rivals

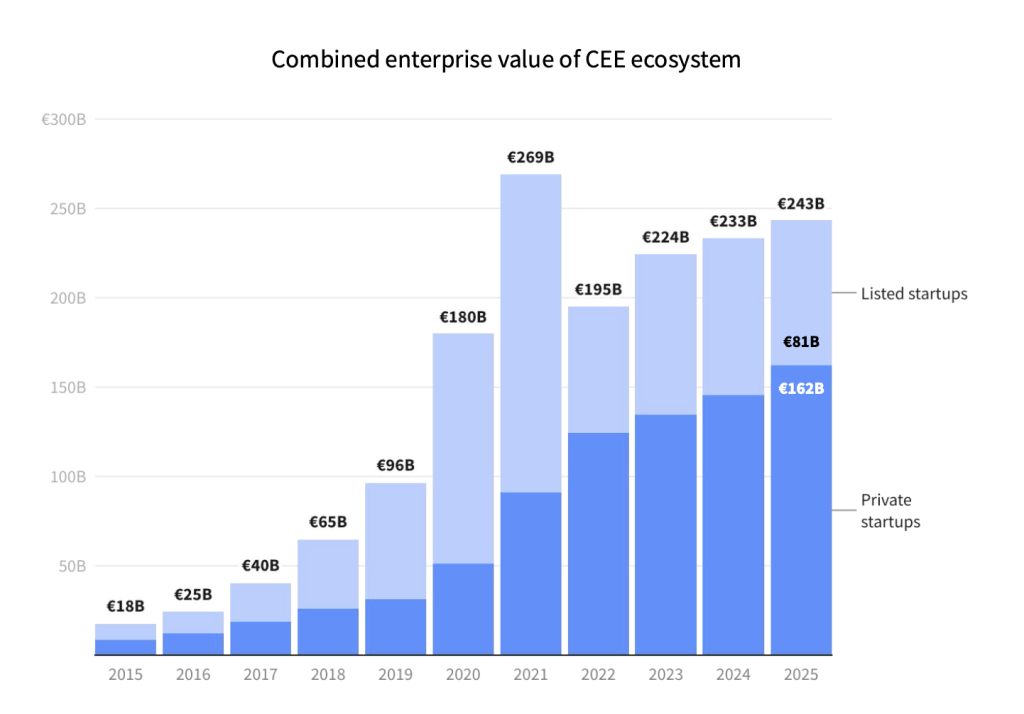

Reading Time: 4 minutesStartups in Central and Eastern Europe (CEE) are growing faster than in Western Europe and the CEE startup ecosystem is now worth EUR 243bn, according to the CEE Startups 2025 report.

While funding and valuations have surged in recent years, structural challenges remain, including geographic fragmentation, uneven investor coverage, and a persistent exodus of founders relocating to markets such as the US to secure growth capital, the report by data provider Dealroom, startup platform Vestbee and investor SHAPE Capital Partners found.

CEE still reliant on public capital – Vestbee CEO

Vestbee CEO Ewa Chronowska wrote that “while VC as an asset class has gained recognition among LPs, CEE remains heavily reliant on public capital, and continues to lag behind developed ecosystems.

“Over the past decade, the CEE startup ecosystem has evolved… into a dynamic innovation hub with a strong talent pool. However, after the period of abundant capital, 2023-24 marked a sharp decline in funding and deal activity, driven by broader market volatility, rising interest rates, and increased investor caution.

“At the same time, the region continues to face a shortage of growth-stage funding, restricting its ability to systematically scale companies into global category leaders,” Chronowska added.

CEE startups often relocate for funding reasons

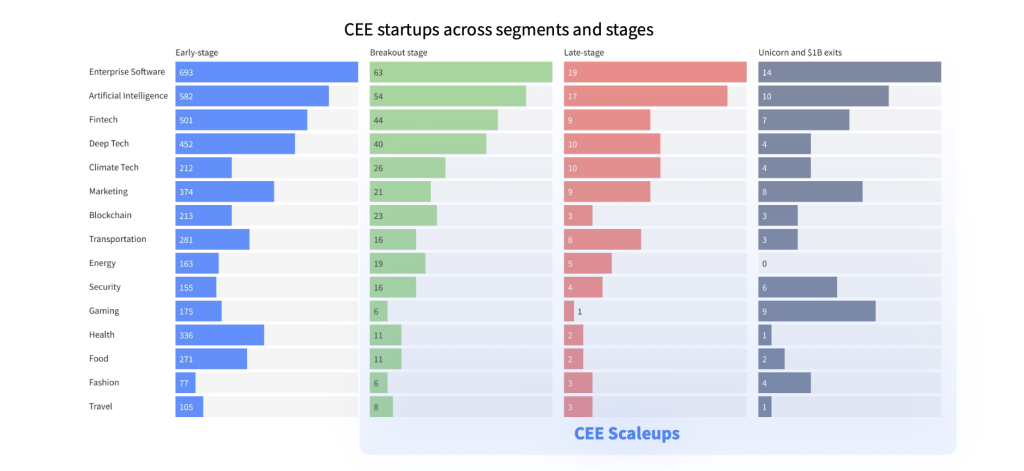

The report identified more than 275 scaleups (startups that have raised at least EUR 15mn) with another 3,800 companies in earlier stages.

CEE startups face chronic underfunding, especially at late stages, the report added. Nearly half of CEE scaleups relocate: 56% to the US and 24% to the UK, to better access funding and global customer bases, while often retaining an operational presence at home.

CEE-based founders frequently keep engineering and R&D teams in the region while moving leadership and sales abroad, with notable examples including Romania’s automation software firm UiPath as well as Ukrainian writing assistant software maker Grammarly and language tutor platform Preply.

Funding gaps and capital scarcity

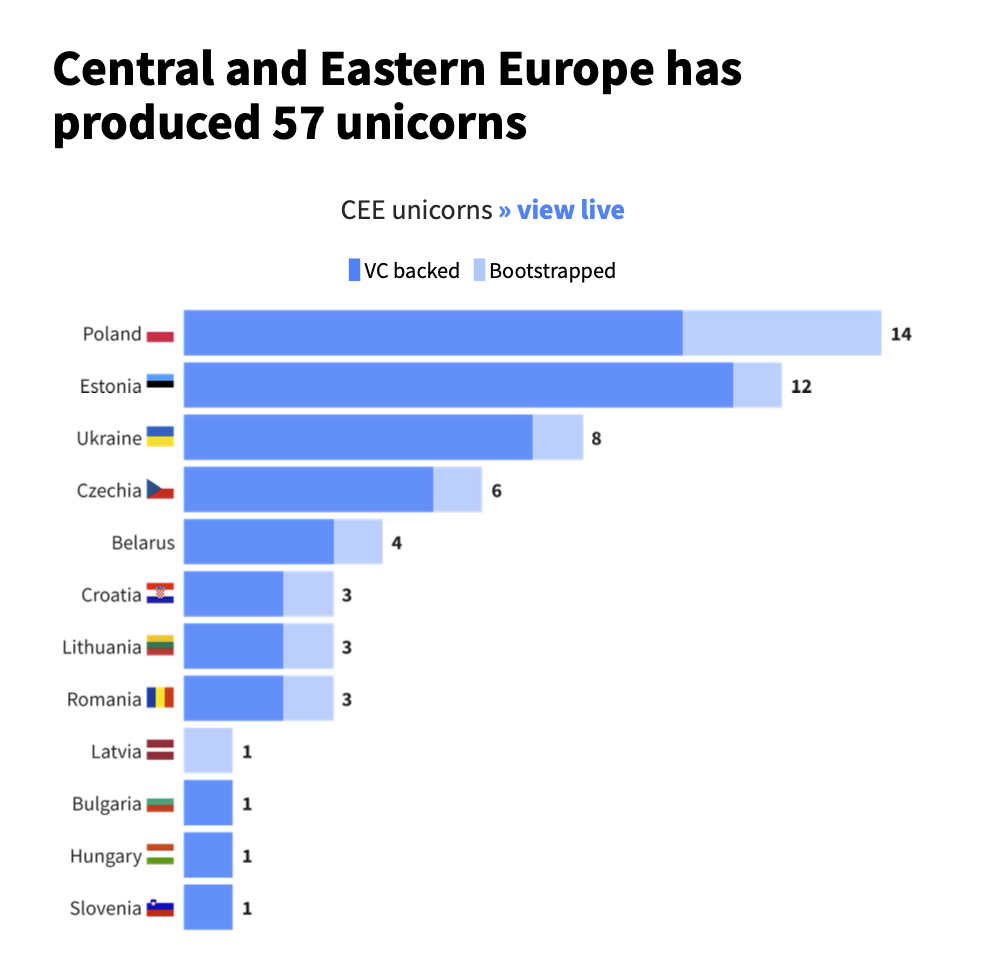

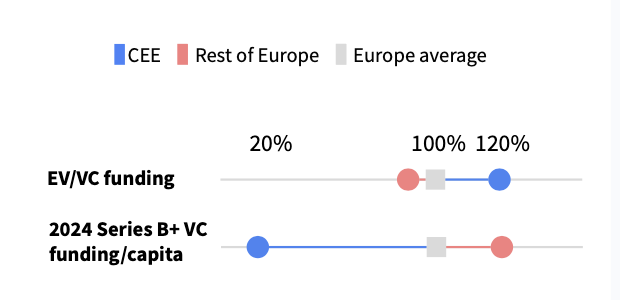

While CEE has produced 57 unicorns, the regional ecosystem still underperforms on a per capita basis compared to Western Europe, and Series B and later funding rounds are particularly scarce.

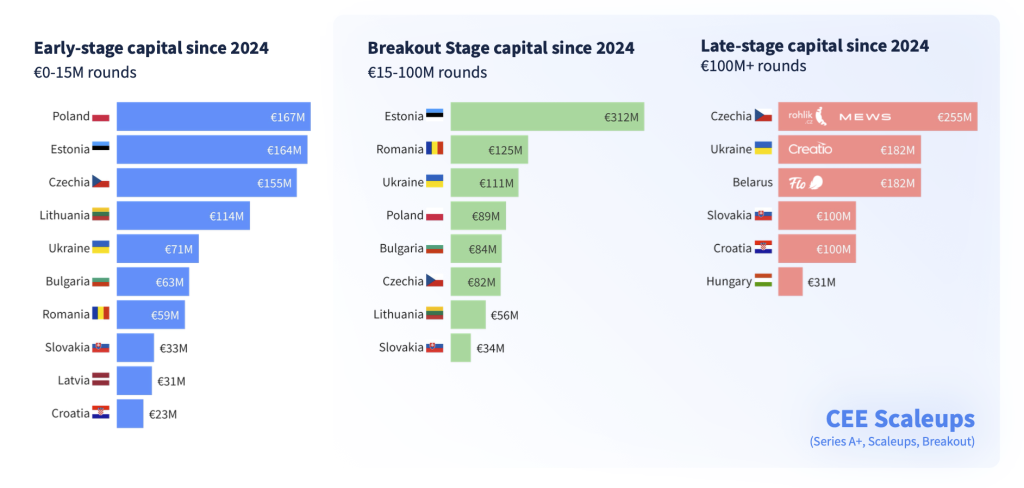

Total VC investment in CEE was EUR 2.3bn in 2024, a fraction of Western European volumes, with EUR 505mn going to late-stage startups. The CEE average for Series C+ rounds was EUR 36.4mn, well below the European average.

Seed and Series A rounds in CEE stayed close to European norms, at EUR 2mn and EUR 9.6mn respectively, but the capital gap widens beyond Series B, which averaged EUR 22.7mn in 2024.

Deep tech and defence emerging, but SaaS still dominates

Software-as-a-service (SaaS) remains the most common business model for CEE startups due to its lean operating model and lower capital intensity.

However, the report also notes rising enthusiasm for deep tech, AI, defence and dual-use technologies. More than 100 defence and dual-use startups now operate in CEE, spurred by geopolitical shifts and regional security investments, it added.

Enterprise software, transportation, and fintech were the most funded verticals in 2024, while energy, robotics, and AI-powered security platforms gained traction.

Ukraine’s tech sector contributed 5% to the national GDP in 2024 and IT export revenues hit USD 6.7bn. Ukrainian startups such as Creatio and Reface still attract significant capital.

Estonia punches well above its weight, accounting for 18% of all scaleups in CEE, with just 0.8% of its population. The country leads in breakout-stage (EUR 15mn-100mn) funding, underscoring the strength of its startup support infrastructure and access to early growth capital.

Outlook: untapped potential

While the CEE region has matured significantly over the past decade, outpacing the European average in enterprise value growth (1,550% vs 700% times, from 2015-25), the region’s ecosystem remains under-indexed on most maturity metrics, including unicorn density, funding-to-GDP ratios, and breakout-stage success rates.

The rapporteurs call for greater access to domestic growth capital to stop promising startups from relocating. “To safeguard European sovereignty and competitiveness, it is crucial to provide local funding to CEE scaleups at their growth stage,” SHAPE Capital’s Andreas Nemeth wrote in the report.

“To safeguard European sovereignty and competitiveness, it is crucial to provide local funding to CEE scaleups at their growth stage. This is our mission. Let’s shape the future together.

“CEE is proving itself as a powerhouse of innovation, resilience, and global ambition. Despite economic headwinds, the region continues to produce world-class entrepreneurs who build and scale transformative companies. With deep technical talent and a thriving scaleup ecosystem, CEEʼs impact on the global tech landscape is undeniable,” Nemeth added.

“The success of companies like UiPath, (Czech grocery retailer) Rohlik, (Estonian mobility company) Bolt, (Lithuanian online marketplace firm) Vinted and (Estonian SaaS management tool developer) Pipedrive has validated the regionʼs potential, attracting increased interest from global VCs such as Sequoia and a16z,” Chronowska underlined.