CEE mulls ramifications of Trump’s victory on trade, defence, environment

As Donald Trump officially declared his victory in the US election, he received congratulations from numerous Central and Eastern Europe (CEE) leaders including Polish President Andrzej Duda and Hungarian Prime Minister Viktor Orban.

However, CEE politicians and observers are now wondering what the leadership change in Washington will bring, as it raises questions regarding defence, the economy, and trade, particularly in light of the threat of protectionist measures from a Trump administration.

Trade war could hit CEE

Trump’s proposed tariffs signal an impending trade war that could impact global markets and are not expected to benefit EU economies. Significant hikes (for example 10% on US imports and 60% on imports from China) could reduce global GDP by 0.6% in 2025, and see it shrink further through to 2027. Implementing broader tariffs would exacerbate business uncertainty, delay investment and dampen economic growth across the Eurozone.

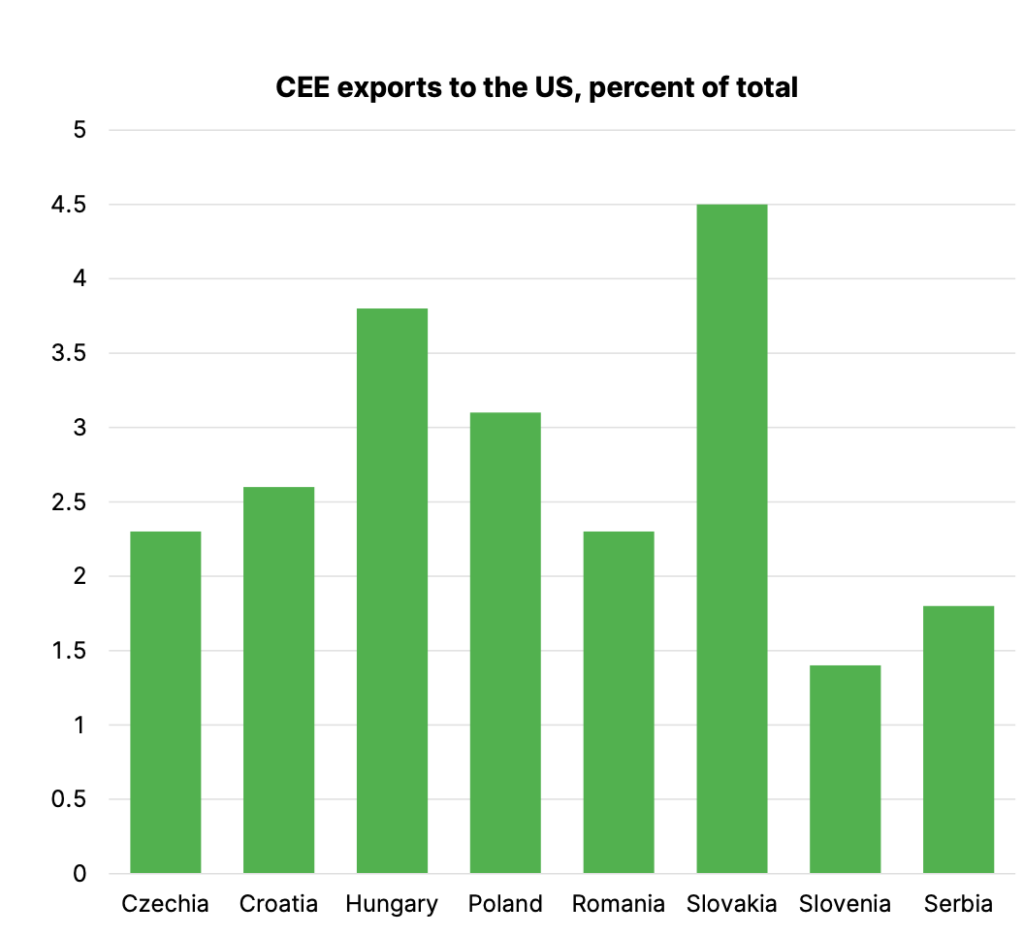

Erste Group noted that while exports to the US make up a small portion of total exports for most CEE countries, Slovakia and Hungary are most exposed. Slovakia exports 4.5% of its total goods to the US, and Hungary’s 3.8%. These exports are predominantly in the automotive sector, with vehicles and automotive parts being the top goods.

Other CEE countries including Czechia, Croatia and Poland, have a higher reliance on exports to Germany, where the share ranges between 20% and 30%. Given the deep economic ties between Germany and CEE, a reduction in Germany’s GDP would directly impact the region. For example, Romania and Czechia would see GDP growth fall by up to 1%, while Poland, Slovakia, and Hungary would experience more moderate declines of 0.5-0.8%.

Poland, Romania increasingly key to defence

A renewed push for higher defence spending under Trump could put pressure on CEE countries that are not meeting the 2% of GDP target, potentially straining relationships within the alliance, Erste writes.

The US may be scaling back its involvement in European security, which could push Europe to consider long-term plans for sustainable defence infrastructure that reduces reliance on the global superpower.

However, Poland’s large-scale arms purchases and role as a key logistics hub for NATO, position it as a key regional player. Since Russia invaded Ukraine, and despite a change of government, Poland has been consistently supportive, sending huge amounts of military hardware, including tanks, artillery and fighter jets. The country also hosts several key NATO operations, including the reestablished V Corps headquarters and the NATO-Ukraine training centre in Bydgoszcz, north Poland.

Romania, which has been a strong advocate for Ukraine, remains a key player on NATO’s south-eastern flank and has transferred advanced air defence systems to its neighbour. Romania’s position is strengthened by its strategic role in NATO’s operations, including the enlargement of the Mihail Kogalniceanu Airbase, which is undergoing a EUR 2.5bn expansion to accommodate permanent NATO troops.

Support for Ukraine remains a critical issue for CEE, particularly as the conflict with Russia continues. While the US has provided substantial military and financial support, Trump’s previous stance on Ukraine has raised concerns in CEE. Trump has called for an end to the “endless flow of American treasure” to Ukraine, advocating for European countries to assume a greater share of the financial burden.

On Sunday, 11 November, the president-elect’s son Donald Trump Jr. said there would be no place in his father’s administration for “war hawks” amid growing signs he will follow through on promises to attempt to being a swift end to the conflict in Ukraine.

Trump, CEE, NATO: bluster or new reality?

Trump has repeatedly said the US will not support countries failing to meet NATO spending commitments. During Trump’s previous term, his administration was supportive of Poland, particularly in terms of security and defence. Poland’s commitment to defence spending, now approaching 5% of its GDP, reflects Trump’s push for European countries to invest more in their own defence, a sentiment shared by other CEE nations such as Estonia.

According to Polish observers, this focus on defence will likely continue, with the US expected to push European countries to increase their contributions to NATO.

Amid looming global tensions, from Russia, to North Korea, Poland looks set to play a significant role in shaping the region’s defence strategy. As the upcoming EU presidency holder, Poland and other CEE countries are positioned to lead on this front.

President Duda’s April visit to Washington, where he met Trump privately, was described as friendly and productive, and the outcome of Poland’s presidential election next year will influence the country’s approach to the US.

Warsaw Mayor Rafal Trzaskowski, Duda’s likely opponent next year, said at a rally on Sunday that “Poland could become Europe’s political leader amid a looming government collapse in Germany and an unstable political situation in France.”

Trzaskowski noted that Poland is the only NATO member that spends “almost 5% of its GDP” on defence, making it “a role model in NATO and the EU”. According to estimates, Poland could spend as much as 4.7% of its GDP on defence next year.

Whoever emerges victorious in Poland’s presidential race will continue to emphasise the importance of US-Poland relations, especially in defence and economic collaboration, regardless of the electoral outcome in Poland. Whether the connection is more than merely transactional will be revealed as Trump shifts from campaign mode to a more pragmatic dynamic.

On the environment, Trump’s scepticism towards climate science could also impact green initiatives in CEE, as his campaign rhetoric has suggested an upcoming rollback on recent progress towards sustainability, directly conflicting with the EU’s Green Deal objectives of achieving climate neutrality by 2050. A shift of trade policies to fossil fuels, could lessen Europe’s competitiveness in the green technology sector and hinder advancement.

Recent Posts

Bulgaria’s euro debate intensifies as pro-EU opposition pushes January adoption date

Bulgaria’s pro-European opposition has tabled a declaration committing the country to join the Eurozone on…

Romania powers up CEE’s largest EV hub on EU-backed ultra-fast charging corridor

OMV Petrom has inaugurated Romania's largest electric vehicle (EV) charging hub on the A1 motorway…

Ukraine arrests pair for spying for Hungary

The Security Service of Ukraine (SBU) has arrested two Ukrainian military veterans in Zakarpattia, west…

Hungary pays neighbours to avoid blackouts: lessons from Spain’s recent energy crisis

Hungary currently leads the world for share of solar energy in its energy mix, as…

Rama set to retain power in Albania election

Albanian Prime Minister Edi Rama has claimed victory in Albania’s parliamentary election on Sunday, 11…

Bosnia’s EU accession requires pro-EU coalition – high representative

The EU can formally begin accession negotiations with Bosnia and Herzegovina (BiH) when a stable…